I'm back to Corvallis, Oregon for a new adventure after 14 years as a scuba instructor/Coast Guard licensed boat Captain/dive company owner in Kona Hawaii. This blog will be a combination of my real estate work life and my personal adventures in Corvallis, Albany and the surrounding world. Feel free to join me on these new journeys.

Keller Williams Mid Willamette real estate agent

Steve Frisbie is a licensed real estate agent in the State of Oregon. REALTOR®. Equal Opportunity Housing Provider. Each office is independently owned and operated.

Tuesday, December 24, 2019

Sunday, December 22, 2019

Lots of deer in our Corvallis neighborhood....

One of the things I like about northwest Corvallis is the deer. They can be a bit of a pain at times if you're a gardener. You need to either fence things off or grow "deer tolerant " plants. We grow our vegetables in pots off the upper decks.

This buck has been hanging out in our yard the last couple of afternoons. We had a bigger one for a few afternoons a couple weeks ago. Does and yearlings have been around as well, but not at the same time as the bucks.

This buck has been hanging out in our yard the last couple of afternoons. We had a bigger one for a few afternoons a couple weeks ago. Does and yearlings have been around as well, but not at the same time as the bucks.

Here's a handy article to read when you are considering getting a mortgage loan for a new home....

-

Documents You Need for Mortgage Pre-Approval: A Checklist for Each Type of Loan

Whether you’re self-employed or applying for an FHA or USDA loan, here’s the pre-approval paperwork you need. Read

Visit houselogic.com for more articles like this.

Copyright 2019 NATIONAL ASSOCIATION OF REALTORS®

Thursday, December 19, 2019

Wednesday, December 4, 2019

Tuesday, June 11, 2019

Majestic Falls and Royal Terrace Falls outside of Lebanon, Oregon...

Went for a nice little hike at McDowell Creek Falls park outside of Lebanon on an overcast Memorial day. Here's Royal Terrace falls and Majestic Falls. It's just short of a two mile loop to do both sets of falls if you do the full loop, probably a bit over half that if you go the shorter route to the bottom of both falls.

Home ownership can help increase wealth.....

How Homeownership Delivers Unsurpassed Family Wealth

There are many financial benefits to homeownership, but probably none more important than its ability to create family wealth.

How Housing Matters is a joint project of the Urban Land Institute and the MacArthur Foundation. It is an online resource for research and information on how homeownership contributes to individual and community success.

Their article, The First Rung on the Ladder to Economic Opportunity Is Housing, explains the importance of homeownership to a family’s financial health. In that article, they simply stated:

“The ladder to economic success can stretch only so high without the asset-building power of homeownership.”

To this point, National Association of Realtors’ (NAR) Economists’ Outlook Blog revealed in a recent post:

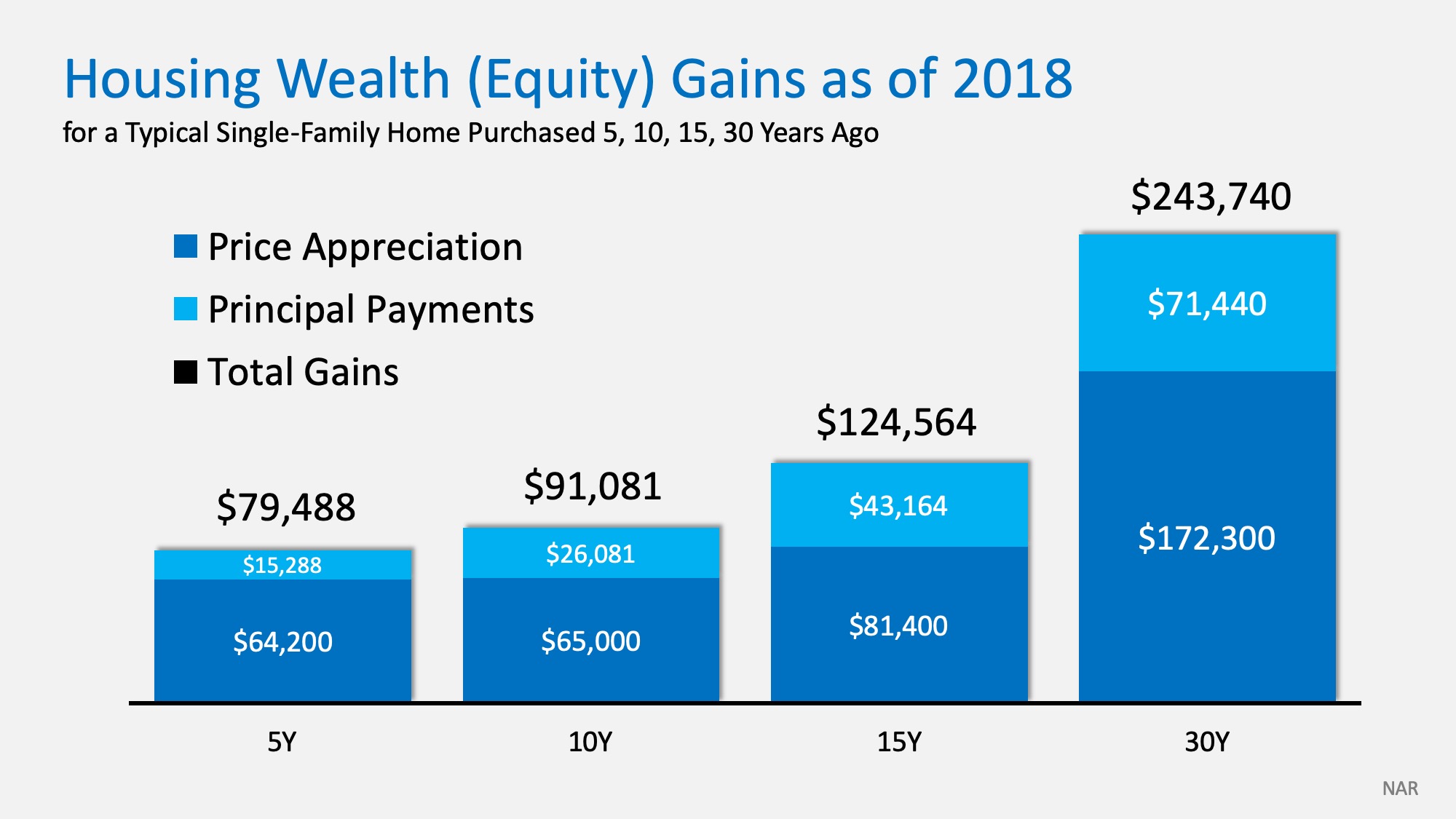

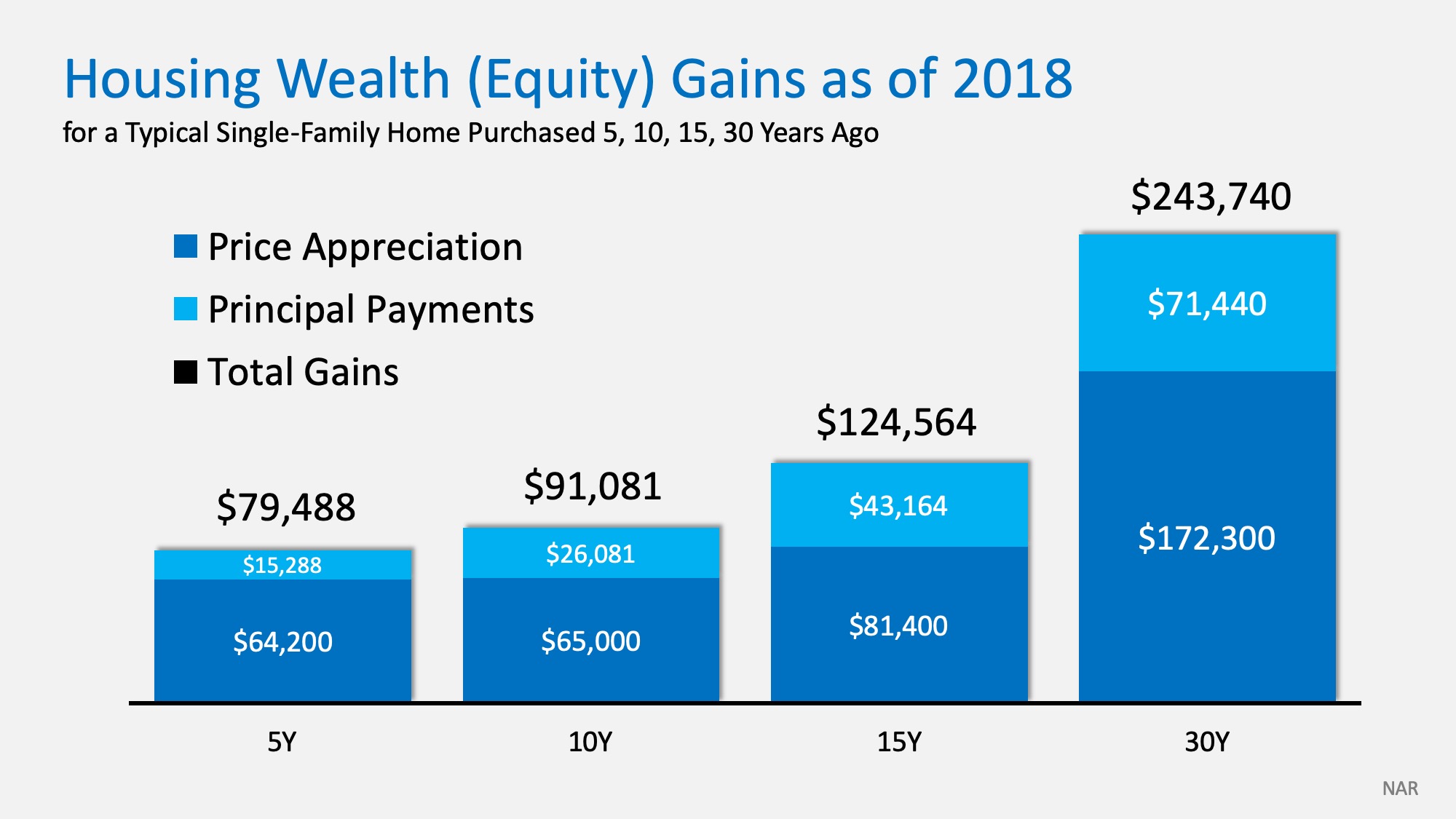

“Housing wealth contributes positively to the homeowner’s and children’s economic condition, because home equity can be tapped for expenditures such as investing in another property (which can generate rental income), home renovation (which further increases the home value), a child’s college education, emergency or major life events, or expenses in retirement…Housing wealth (or net worth or equity) is built up over time via the home price appreciation and the principal payments that the homeowner makes on the loan.”

Here is a graph showing the build-up of wealth over time: Just last month, NAR’s Chief Economist, Lawrence Yun, explained that even though home appreciation has slowed, homeowners are still building wealth:

Just last month, NAR’s Chief Economist, Lawrence Yun, explained that even though home appreciation has slowed, homeowners are still building wealth:

Just last month, NAR’s Chief Economist, Lawrence Yun, explained that even though home appreciation has slowed, homeowners are still building wealth:

Just last month, NAR’s Chief Economist, Lawrence Yun, explained that even though home appreciation has slowed, homeowners are still building wealth:“Homeowners in the majority of markets are continuing to enjoy price gains, albeit at a slower rate of growth. A typical homeowner accumulated $9,500 in wealth over the past year.”

Later in life, this wealth is crucial…

This wealth is important to a family’s retirement plans. In a recent report from the Joint Center for Housing Studies at Harvard University titled, Housing America’s Older Adults 2018, they revealed that a renter 65 years old or older has a net worth of $6,710. Meanwhile, a homeowner 65+ years old has a net worth of $319,200. That huge difference will allow for a dramatic upgrade in one’s lifestyle during your retirement years.

Bottom Line

Homeownership builds wealth. This, in turn, allows families to have more and better options when it comes to their children and their life in retirement.

Tuesday, April 2, 2019

A few pictures from the Lewisburg Saddle hiking area outside of Corvallis...

Hi there. I hadn't posted in a while, got kind of busy during the holidays and got away from paying attention to the blog. Time to get started up again.

Here's a few quick photos from the Lewisburg Saddle. It's just north of Corvallis, literally about 5 minutes from Crescent Valley High School. Just head west on Lewisburg road, turn right on Sulphur Springs road then head uphill to the top and you are there. They have three parking areas up there and the place has several hiking trails you can access from the main entrance.

I went there a few times last year, then I started going back up there this winter to hike in the snow. When you see snow on the hills on the north side of Corvallis, this is a great place to access for a snowy walk. Just make sure to wear some shoes with good tread, it can get a bit slick and icy if things melt and re-freeze.

I went there a few times last year, then I started going back up there this winter to hike in the snow. When you see snow on the hills on the north side of Corvallis, this is a great place to access for a snowy walk. Just make sure to wear some shoes with good tread, it can get a bit slick and icy if things melt and re-freeze.

This is a great place to walk to get started back on hiking. There are several logging roads, it's part of Mac Forest (a lot of research is done there), and there are other trails that split off the main logging roads to hike. Right now I'm kinda starting over for the year and I've been doing the new growth and old growth trail loops that cross each other. They are fairly mild hiking trails but I'm still huffing pretty good (although I'm improving every week). Once those are easy I'm going to look for some more challenging trails to do with Pat.

Homebuyers Shouldn’t Worry About 2008 All Over Again

Last week, realtor.com released a survey of active home shoppers (those who plan to purchase their next home in 1 year or less). The survey asked their opinion on an impending recession and its possible impact on the housing market.

Two major takeaways from the survey:

- 42% believe a recession will occur this year or next (another 16% said 2021)

- 59% believe the housing market would fare the same or worse than it did in 2008

Why all the talk about a recession recently?

Over the last year, four separate surveys have been taken asking when we can expect the next recession to occur:

- The Pulsenomics Survey of Market Analysts

- The Wall Street Journal Survey of Economists

- The Duke University Survey of American CFOs

- The National Association of Business Economics

70% of all respondents to the four surveys believe that a recession will occur in 2019 or 2020 with an additional 18% saying 2021.

However, we must realize that a recession does not mean we will experience another housing crash. According to the dictionary definition, a recession is:

“A period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.”

During the last recession, a dramatic fall in home values helped cause it.

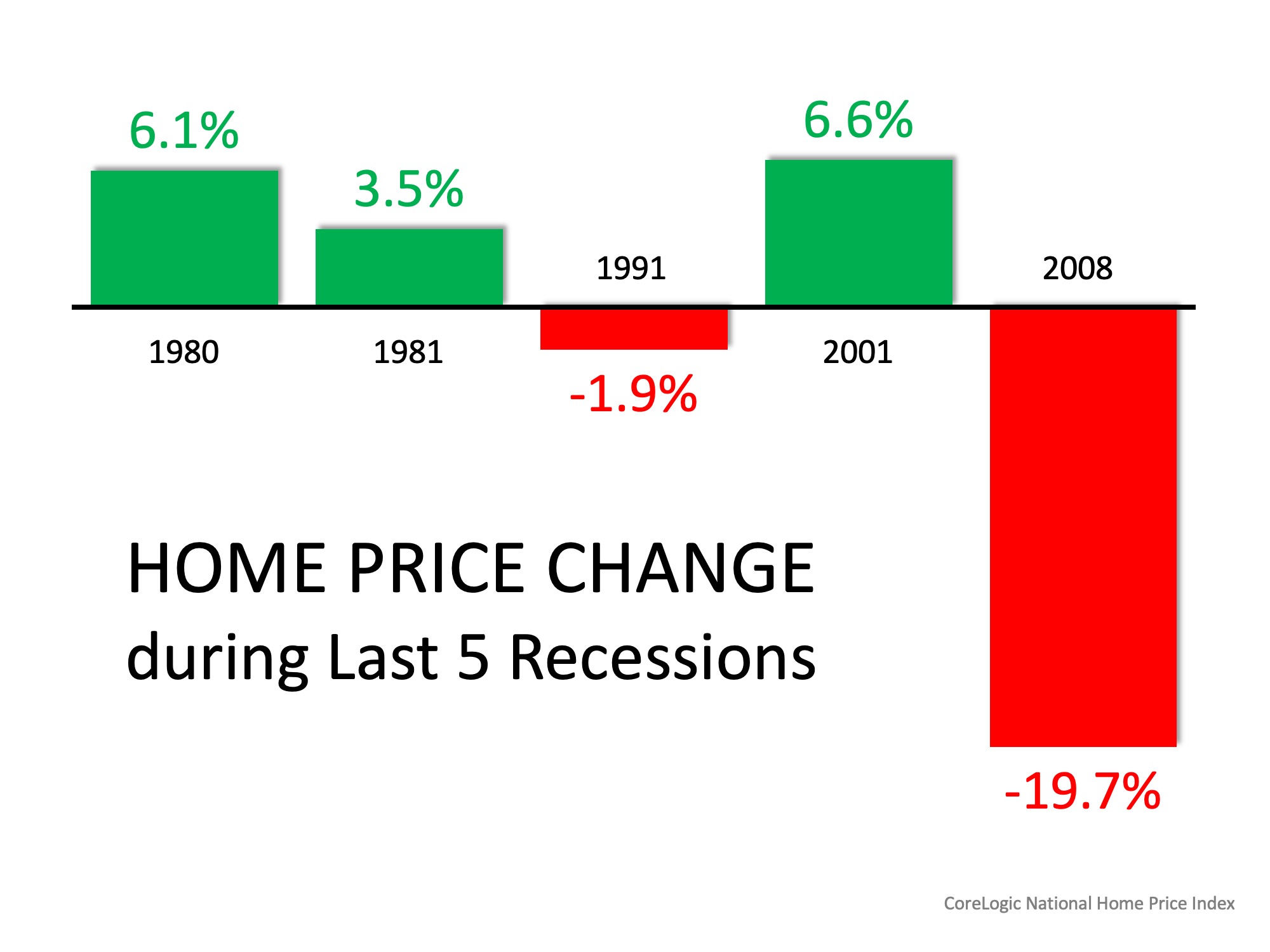

However, according to research done by CoreLogic, home values weren’t negatively impacted as they were in 2008 during the previous four recessions:

During the four recessions prior to 2008, home values depreciated only once (at a level that was less than 2%). The other three times home values appreciated, twice well above the historic norm of 3.6%.

Bottom Line

If there is an economic slowdown in our near future, there is no need for fear to set in. Most experts agree with Ralph McLaughlin, CoreLogic’s Deputy Chief Economist, who recently explained that there’s no reason to panic right now, even if we may be headed for a recession.

“We’re seeing a cooling of the housing market, but nothing that indicates a crash.”

Subscribe to:

Posts (Atom)