I'm back to Corvallis, Oregon for a new adventure after 14 years as a scuba instructor/Coast Guard licensed boat Captain/dive company owner in Kona Hawaii. This blog will be a combination of my real estate work life and my personal adventures in Corvallis, Albany and the surrounding world. Feel free to join me on these new journeys.

Keller Williams Mid Willamette real estate agent

Steve Frisbie is a licensed real estate agent in the State of Oregon. REALTOR®. Equal Opportunity Housing Provider. Each office is independently owned and operated.

Tuesday, June 16, 2020

Is the economic recovery already happening?

I hope so. It seems that the stock market has recovered most of it's losses and people are getting back to work. I hope everyone is recovering, it's been a difficult time for many. Here's to good times ahead. Thought I'd pass this along...

Friday, May 22, 2020

Now may be a great time to refinance your home....

Interest rates are so low my wife and I had to bite... and refinance our home. We had done a re-fi a while back to get some money for a something we wanted to do and unfortunately it was while rates had risen a bit. Today the rates are very low and we had to take the opportunity to save some money - we saved about a percent and a half off of our old rate. A percent and a half doesn't sound like much, but in our case it's huge, we're talking hundreds of dollars a month - well worth the minimal effort and time it took to refinance.

If you have a relatively high interest rate on you home loan, it may be worth your while to make a couple of phone calls or at least go online and inquire at a couple of mortgage loan sites. They'll likely call you back quickly. What we found was it's worthwhile checking with a few places... your bank or credit union, a local mortgage company or two and perhaps an online mortgage place or two. We found that the rates they would give us varied, the ending APR they gave us varied, and the fees they charged varied quite a bit.

Keep in mind, you'll need to run the numbers before committing. Depending on your credit rating, the size of your loan, time left on it, rate on the original loan, what the fees will run on the refinancing, and a couple other factors, it may not be worthwhile refinancing... or it could save you a lot of money. You'll need to run the numbers, but if it works out in your favor you should consider it. In our case what we're saving will pay for all of our refinancing costs in about a half a year, the rest is bonus money we can put back into the house , paying off the loan earlier, investing towards retirement or just plain fun. It was well worth it for us.

For those of you who are considering taking out a home loan to purchase a home... Now is a great time compared to historical rates. There's a chance rates could go either way from here, but current rates are still very low, which could mean lower payments or more house for the same payment compared to earlier dates... in most cases it's a win.

Interest Rates Hover Near Historic All-Time Lows [INFOGRAPHIC]

![Interest Rates Hover Near Historic All-Time Lows [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/05/21093649/20200522-MEM-1046x837.png)

Some Highlights

- Mortgage interest rates have dropped considerably this spring and are hovering at a historically low level.

- Locking in at a low rate today could save you thousands of dollars over the lifetime of your home loan.

- Let’s connect to determine the best way to position yourself for a move in today’s market.

Went for a hike out at Finley Wildlife Refuge last weekend...

Sunday my wife and I decided to go for a little bit of a walk out at the Finley Wildlife Refuge about 10-15 minutes south of Corvallis. We'd never actually been there before so it was great fun visiting a new spot.

We entered from the Bellfountain Road entrance at Finley Refuge Road. They have the road gated off for now, I believe it's a Covid-19 shutdown thing as the visitor center was closed, but you're still welcome to walk the myriad of trails they have in there.

We chose to take the Mill Hill Loop trail, which from this entrance is the first trail we came across. The entire loop from the entrance and back is right at about 4 miles with about a 450 foot elevation change overall. From the visitor's center I believe it's about a mile shorter of a hike. I'd say it's an easy to moderate incline in spots, nothing real difficult, otherwise it's a relatively level hike for the bulk of it.

We chose to take the Mill Hill Loop trail, which from this entrance is the first trail we came across. The entire loop from the entrance and back is right at about 4 miles with about a 450 foot elevation change overall. From the visitor's center I believe it's about a mile shorter of a hike. I'd say it's an easy to moderate incline in spots, nothing real difficult, otherwise it's a relatively level hike for the bulk of it.We'll definitely be going back, there's several hiking trails to explore!

Thursday, May 14, 2020

Here's some thoughts on how home sales will shake down once the Covid-19 shutdown restrictions loosen....

Driving around Corvallis it does seem like there are fewer houses coming on the market right now, but I'm also seeing a lot of signs coming down.... people are still buying. It'll be interesting to see how the local May sales stats look. Here's a video to check out. If you are thinking about making a move in the future, give me a text or a call. I'm happy to help if you have any questions.

Looks like people are starting to shift to moving to less populated areas...

A Surprising Shift to the ‘Burbs May Be on the Rise

While many people across the U.S. have traditionally enjoyed the perks of an urban lifestyle, some who live in more populated city limits today are beginning to rethink their current neighborhoods. Being in close proximity to everything from the grocery store to local entertainment is definitely a perk, especially if you can also walk to some of these hot spots and have a short commute to work. The trade-off, however, is that highly populated cities can lack access to open space, a yard, and other desirable features. These are the kinds of things you may miss when spending a lot of time at home. When it comes to social distancing, as we’ve experienced recently, the newest trend seems to be around re-evaluating a once-desired city lifestyle and trading it for suburban or rural living.

George Ratiu, Senior Economist at realtor.com notes:

“With the re-opening of the economy scheduled to be cautious, the impact on consumer preferences will likely shift buying behavior…consumers are already looking for larger homes, bigger yards, access to the outdoors and more separation from neighbors. As we move into the recovery stage, these preferences will play an important role in the type of homes consumers will want to buy. They will also play a role in the coming discussions on zoning and urban planning. While higher density has been a hallmark of urban development over the past decade, the pandemic may lead to a re-thinking of space allocation.”

The Harris Poll recently surveyed 2,000 Americans, and 39% of the respondents who live in urban areas indicated the COVID-19 crisis has caused them to consider moving to a less populated area. Today, moving outside the city limits is also more feasible than ever, especially as Americans have quickly become more accustomed to – and more accepting of – remote work. According to the Pew Research Center, access to the Internet has increased significantly in rural and suburban areas, making working from home more accessible. The number of people working from home has also spiked considerably, even before the pandemic came into play this year.

Today, moving outside the city limits is also more feasible than ever, especially as Americans have quickly become more accustomed to – and more accepting of – remote work. According to the Pew Research Center, access to the Internet has increased significantly in rural and suburban areas, making working from home more accessible. The number of people working from home has also spiked considerably, even before the pandemic came into play this year.

Today, moving outside the city limits is also more feasible than ever, especially as Americans have quickly become more accustomed to – and more accepting of – remote work. According to the Pew Research Center, access to the Internet has increased significantly in rural and suburban areas, making working from home more accessible. The number of people working from home has also spiked considerably, even before the pandemic came into play this year.

Today, moving outside the city limits is also more feasible than ever, especially as Americans have quickly become more accustomed to – and more accepting of – remote work. According to the Pew Research Center, access to the Internet has increased significantly in rural and suburban areas, making working from home more accessible. The number of people working from home has also spiked considerably, even before the pandemic came into play this year.Bottom Line

If you have a home in the suburbs or a rural area, you may see an increasing number of buyers looking for a property like yours. If you’re thinking of buying and don’t mind a commute to work for the well-being of your family, you may want to consider looking at homes for sale outside the city. Let’s connect today to discuss the options available in our area.

Monday, April 27, 2020

Today’s Expert Insight on the Housing Market [INFOGRAPHIC]

![Today’s Expert Insight on the Housing Market [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/04/23123713/20200424-MEM-EN-1046x1308.jpg)

Some Highlights

- According to Lawrence Yun, Chief Economist at NAR, home prices are forecasted to rise.

- Results from the Existing Home Sales Report note that home sales declined in March due to the coronavirus, but prices are still strong.

- Let’s connect so you can better understand your home’s value today.

Tuesday, April 21, 2020

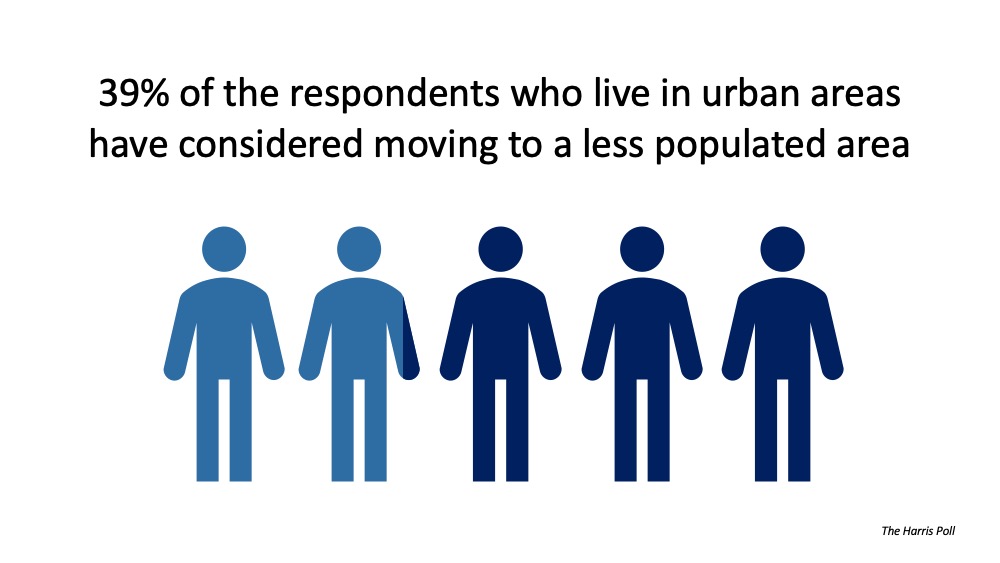

Here's a little video on house values and recessions...

I wish I had a little crystal ball so I could tell exactly will happen to home values over the next few months, but it may not be anything like the price drops back in 2008. In three of the last 5 recessions home prices actually went up.

Coming into 2008 there were plenty of homes on the market and plenty of new homes being built, the home equity loan market was much more active than it is now, and there were lots of BAD loans out there. After that crisis loan programs tightened up, new housing starts dropped to realistic and now there's actually less inventory homes out there for sale. Hopefully home values will continue to grow into the future.

If you have any questions about real estate, feel free to get in touch with me, I'm always happy to talk shop and give out free information. www.propertybysteve.com

Coming into 2008 there were plenty of homes on the market and plenty of new homes being built, the home equity loan market was much more active than it is now, and there were lots of BAD loans out there. After that crisis loan programs tightened up, new housing starts dropped to realistic and now there's actually less inventory homes out there for sale. Hopefully home values will continue to grow into the future.

If you have any questions about real estate, feel free to get in touch with me, I'm always happy to talk shop and give out free information. www.propertybysteve.com

Saturday, April 18, 2020

Homes are still selling in Corvallis and Albany....

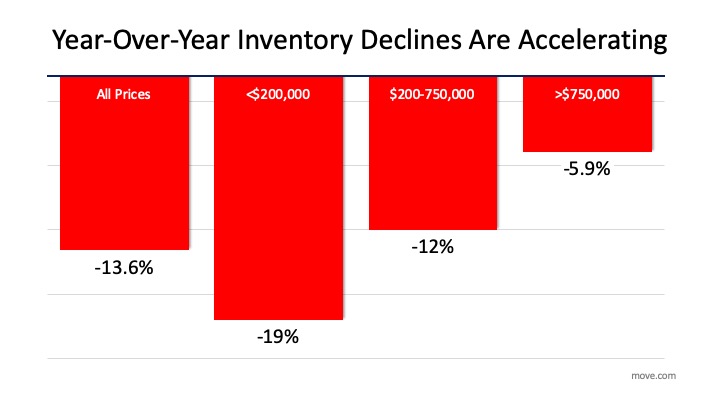

Today’s Homebuyers Want Lower Prices. Sellers Disagree.

The uncertainty the world faces today due to the COVID-19 pandemic is causing so many things to change. The way we interact, the way we do business, even the way we buy and sell real estate is changing. This is a moment in time that’s even sparking some buyers to search for a better deal on a home. Sellers, however, aren’t offering a discount these days; they’re holding steady on price.

According to the most recent NAR Flash Survey (a survey of real estate agents from across the country), agents were asked the following two questions:

1. “Have any of your sellers recently reduced their price to attract buyers?”

Their answer: 72% said their sellers have not lowered prices to attract buyers during this health crisis.

2. “Are home buyers expecting lower prices now?”

Their answer: 63% of agents said their buyers were looking for a price reduction of at least 5%.

What We Do Know

In today’s market, with everything changing and ongoing questions around when the economy will bounce back, it’s interesting to note that some buyers see this time as an opportunity to win big in the housing market. On the other hand, sellers are much more confident that they will not need to reduce their prices in order to sell their homes. Clearly, there are two different perspectives at play.

Bottom Line

If you’re a buyer in today’s market, you might not see many sellers lowering their prices. If you’re a seller and don’t want to lower your price, you’re not alone. If you have questions on how to price your home, let’s connect today to discuss your real estate needs and next steps.

Wednesday, April 1, 2020

Fitton Green Natural Area on the edge of Corvallis is still open for now....

I decided to get out of the house (social distancing means working from home for the most part) and go for a short walk today, wanted to get in 15 minutes or so of uphill walking. I decided to check out the Fitton Green Natura Area to see if it is still open and how many people were out and about. It's been kind of wet so when I arrived there were no other cars in the lot, there was one car there when I finished my little walk.

It was spitting a little of slush when I went and was basically quite foggy so I didn't take any landscape style photos. I haven't been there very many times so I don't really know the trails, but the one I've been on, the Allen Throop Loop, provides great open views of the area on most days, visibility was limited today. Hopefully the county will be able to continue to make places like this available to people as long as they continue practicing social distancing. It's nice to have the option to get out in a more natural setting.

Stay healthy,

Steve

Tuesday, March 31, 2020

Refinance rates are very low, should I refinance my house now?

Is Now a Good Time to Refinance My Home?

With interest rates hitting all-time lows over the past few weeks, many homeowners are opting to refinance. To decide if refinancing your home is the best option for you and your family, start by asking yourself these questions:

Why do you want to refinance?

There are many reasons to refinance, but here are three of the most common ones:

1. Lower Your Interest Rate and Payment: This is the most popular reason. Is your current interest rate higher than what’s available today? If so, it might be worth seeing if you can take advantage of the current lower rates.

2. Shorten the Term of Your Loan: If you have a 30-year loan, it may be advantageous to change it to a 15 or 20-year loan to pay off your mortgage sooner rather than later.

3. Cash-Out Refinance: You might have enough equity to cash out and invest in something else, like your children’s education, a business venture, an investment property, or simply to increase your cash reserve.

Once you know why you might want to refinance, ask yourself the next question:

How much is it going to cost?

There are fees and closing costs involved in refinancing, and The Lenders Network explains:

“As an example, let’s say your mortgage has a balance of $200,000. If you were to refinance that loan into a new loan, total closing costs would run between 2%-4% of the loan amount. You can expect to pay between $4,000 to $8,000 to refinance this loan.”

They also explain that there are options for no-cost refinance loans, but be on the lookout:

“A no-cost refinance loan is when the lender pays the closing costs for the borrower. However, you should be aware that the lender makes up this money from other aspects of the mortgage. Usually charging a slightly higher interest rate so they can make the money back.”

Keep in mind that, given the current market conditions and how favorable they are for refinancing, it can take a little longer to execute the process today. This is because many other homeowners are going this route as well. As Todd Teta, Chief Officer at ATTOM Data Solutions notes about recent mortgage activity:

“Refinancing largely drove the trend, with more than twice as many homeowners trading in higher-interest mortgages for cheaper ones than in the same period of 2018.”

Clearly, refinancing has been on the rise lately. If you’re comfortable with the up-front cost and a potential waiting period due to the high volume of requests, then ask yourself one more question:

Is it worth it?

To answer this one, do the math. Will it help you save money? How much longer do you need to own your home to break even? Will your current home meet your needs down the road? If you plan to stay for a few years, then maybe refinancing is your best move.

If, however, your current home doesn’t fulfill your needs for the next few years, you might want to consider using your equity for a down payment on a new home instead. You’ll still get a lower interest rate than the one you have on your current house, and with the equity you’ve already built, you can finally purchase the home you’ve been waiting for.

Bottom Line

Today, more than ever, it’s important to start working with a trusted real estate advisor. Whether you connect by phone or video chat, a real estate professional can help you understand how to safely navigate the housing market so that you can prioritize the health of your family without having to bring your plans to a standstill. Whether you’re looking to refinance, buy, or sell, a trusted advisor knows the best protocol as well as the optimal resources and lenders to help you through the process in this fast-paced world that’s changing every day.

Monday, March 30, 2020

Chip Ross Park in Corvallis is still open for the moment....

Went for a hike yesterday up at Chip Ross Park It's on the north side of Corvallis up at the top of Lester Avenue off Highland Drive. During the shut down for the coronavirus it is still open, for now, until further steps are needed. It's been raining the last few days so there were only three or four other groups in the park at the time we went that we saw. Everyone seems to be aware of maintaining social distancing so for now it seems to be a safe place to get out of the house and get a little exercise.

It's a nice little hike, the loop from the parking lot is just a bit over a mile and a half with an elevation uphill change of roughly a bit over 350 feet over the course of the hike. Under normal circumstances there is a trail available on the backside that gives you the ability to go all over the McDonald and Dunn forests, but they're shut down right now so it's been taped off and shut down.

Here's a view from the top it provides a great view of Corvallis. The oak trees are just starting to bud out, in a few weeks it'll be nice and green up there.

Stay healthy,

Stay healthy,Steve

Thursday, March 26, 2020

What does the future of the real estate market look like....

Even if the market slows down right now, now might be a very good time to get a few projects done. Do you have a powder room with 30 year old wall paper you don't care for? Maybe it's time to do a relatively easy project and put an up to date coat or two of paint on it? Do you have a front door knob that you've got to do the 30 second key jiggle to open? Door knobs aren't all that expensive and are easily replaceable. (Quick door knob rant - You may be used to jiggling the key for a bit, but few things say "lack of maintenance" on a house for sale to a potential buyer as fast as having to fight just to get in and look at the place. It can raise questioning thoughts about whether there are more issues likely to appear. Sure it's an easy fix, but many buyers are put off by potential projects, it potentially limits your buying pool a bit). The possibility for projects on an older house can be overwhelming, start with anything "broken" first then think about whether you want to take on cosmetic stuff.

My wife and I did a bunch of projects on our last house in the months prior to going to market, after each one we wished we would have done it years earlier so we could enjoy it. Even if you aren't thinking of selling, now may be the time to do things you've been putting off so you can enjoy it for years to come.

Tuesday, March 24, 2020

OSU temporarily shuts down the McDonald and Dunn research forests to recreational use due to the coronavirus concerns...

I'm not sure if City and County parks with hiking like Chip Ross, Bald Hill, Fitton Green and the likes are shut down yet, it wouldn't surprise me if it happens at some point. I do believe the City has shut down playgrounds. Some of us may have to find another outlet for exercise. For me, worse comes to worse I start walking stairs in my house... infinitely more boring.

Stay healthy,

Steve

Friday, March 20, 2020

Here's some info on where housing prices have gone during past recessions...

A Recession Does Not Equal a Housing Crisis [INFOGRAPHIC]

Some Highlights

- The COVID-19 pandemic is causing an economic slowdown.

- The good news is, home values actually increased in 3 of the last 5 U.S. recessions and decreased by less than 2% in the 4th.

- All things considered, an economic slowdown does not equal a housing crisis, and this will not be a repeat of 2008.

Thursday, March 19, 2020

Are we going to have another housing crash?

Are we going to have another housing crash like in 2008?

With all that is going on with the Covid virus, it's a bit of a cautious time in the real estate industry while things are shaking out. During the last real estate housing crash houses stopped selling, prices dropped (although Corvallis missed having a tremendous drop in home values for the most part - I was living in Hawaii at the time and the state really felt it as prices had nearly tripled in the 6-7 years leading up to 2008) and for areas where prices dropped dramatically many took up to 5-7 years to recover to previous levels.

This time around we won't know until a bit of time passes, however there are many underlying fundamentals that can indicate that this could be potentially just a bump in the road in comparison to what occurred in 2008, assuming there is a reasonably swift recovery from today's virus issues. Check out the following video...

If you are considering a home sale or purchase, let's talk. Right now homes are still selling quite well in Corvallis and the area and I'll be keeping up to date on the Corvallis and Albany area market.

With all that is going on with the Covid virus, it's a bit of a cautious time in the real estate industry while things are shaking out. During the last real estate housing crash houses stopped selling, prices dropped (although Corvallis missed having a tremendous drop in home values for the most part - I was living in Hawaii at the time and the state really felt it as prices had nearly tripled in the 6-7 years leading up to 2008) and for areas where prices dropped dramatically many took up to 5-7 years to recover to previous levels.

This time around we won't know until a bit of time passes, however there are many underlying fundamentals that can indicate that this could be potentially just a bump in the road in comparison to what occurred in 2008, assuming there is a reasonably swift recovery from today's virus issues. Check out the following video...

If you are considering a home sale or purchase, let's talk. Right now homes are still selling quite well in Corvallis and the area and I'll be keeping up to date on the Corvallis and Albany area market.

Tuesday, March 17, 2020

Here's some Corvallis residential real estate sale statistics (from Feb 2020) ...

This is from last month, I'll be following up with the current report for March soon...

Friday, March 13, 2020

Buying a Home: Do You Know the Lingo? [INFOGRAPHIC]

![Buying a Home: Do You Know the Lingo? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/03/09122748/20200313-MEM-EN-1046x1308.jpg)

Highlights:

- Buying a home can be intimidating if you’re not familiar with the terms used throughout the process.

- To point you in the right direction, here’s a list of some of the most common language you’ll hear along the way.

- The best way to ensure your homebuying process is a positive one is to find a real estate professional who will guide you through every aspect of the transaction with ‘the heart of a teacher.’

Woodpeckers and Flickers are pecking on my house.... What to do?

It's that time of year again that we have birds pecking holes in our siding. Usually the first hint that they're showing up is hearing the loud ratta-tat-tat on the chimney vents on the roof. From what I've heard, that's the males trying to impress the nearby females with the loudest possible tapping noises they can make. Usually within a few days the birds start working on the house. I don't know if it's a nesting behavior or digging for potential bugs, but over the years they can cause quite a bit of damage.

What to do? Well, pounding on the walls or going outside to yell at them is a five to ten minute fix. Squirting them with a super-soaker bazooka is extremely satisfying (once, if you have to do it again, not so much) and works for about 10 to 15 minutes usually.

What to do? Well, pounding on the walls or going outside to yell at them is a five to ten minute fix. Squirting them with a super-soaker bazooka is extremely satisfying (once, if you have to do it again, not so much) and works for about 10 to 15 minutes usually.

So far the best solution we've come across is balloons. You can pick them up at the dollar store for a buck each and tie them off near an area they're working on and they'll skedaddle as long as the balloons are still floating. I don't know what it is about birds and balloons, but when I had my pet store years back I kept uncaged birds out in the open and if someone came in with a balloon all heck broke lose... birds flying everywhere. We ended up finding out you could literally hold a balloon in your hand and they'd just look at you, but the moment the balloon started floating, it was freak out time.

The balloons will typically work for a day or two, then you might have to move them. Yesterday I picked up four balloons for various spots around the house and it's been quiet since. You'll want well filled helium balloons, keep in mind when the weather is cool the helium actually shrinks in the balloon and they won't float as well, so you have to be careful if you think about adding extra string because the weight might hold them down.

Other potential solutions, hanging CD or DVD disks on the house apparently can work. Plastic owls make a real good solution... when we lived in Hawaii the mynah birds used to come to our porch to steal the food from our dog's dish, we thought it cute at first, but those things are pooping machines. Plastic owls were found in every garden department there and it worked. I've even heard of attaching rubber snakes to the chimney vent to keep them off it... I'd love to try that one but our roof is so steep I really don't want to get up there. If you've found other solutions feel free to chime in on the comments.

Later,

Steve

What to do? Well, pounding on the walls or going outside to yell at them is a five to ten minute fix. Squirting them with a super-soaker bazooka is extremely satisfying (once, if you have to do it again, not so much) and works for about 10 to 15 minutes usually.

What to do? Well, pounding on the walls or going outside to yell at them is a five to ten minute fix. Squirting them with a super-soaker bazooka is extremely satisfying (once, if you have to do it again, not so much) and works for about 10 to 15 minutes usually.So far the best solution we've come across is balloons. You can pick them up at the dollar store for a buck each and tie them off near an area they're working on and they'll skedaddle as long as the balloons are still floating. I don't know what it is about birds and balloons, but when I had my pet store years back I kept uncaged birds out in the open and if someone came in with a balloon all heck broke lose... birds flying everywhere. We ended up finding out you could literally hold a balloon in your hand and they'd just look at you, but the moment the balloon started floating, it was freak out time.

The balloons will typically work for a day or two, then you might have to move them. Yesterday I picked up four balloons for various spots around the house and it's been quiet since. You'll want well filled helium balloons, keep in mind when the weather is cool the helium actually shrinks in the balloon and they won't float as well, so you have to be careful if you think about adding extra string because the weight might hold them down.

Other potential solutions, hanging CD or DVD disks on the house apparently can work. Plastic owls make a real good solution... when we lived in Hawaii the mynah birds used to come to our porch to steal the food from our dog's dish, we thought it cute at first, but those things are pooping machines. Plastic owls were found in every garden department there and it worked. I've even heard of attaching rubber snakes to the chimney vent to keep them off it... I'd love to try that one but our roof is so steep I really don't want to get up there. If you've found other solutions feel free to chime in on the comments.

Later,

Steve

Thursday, March 5, 2020

Tuesday, March 3, 2020

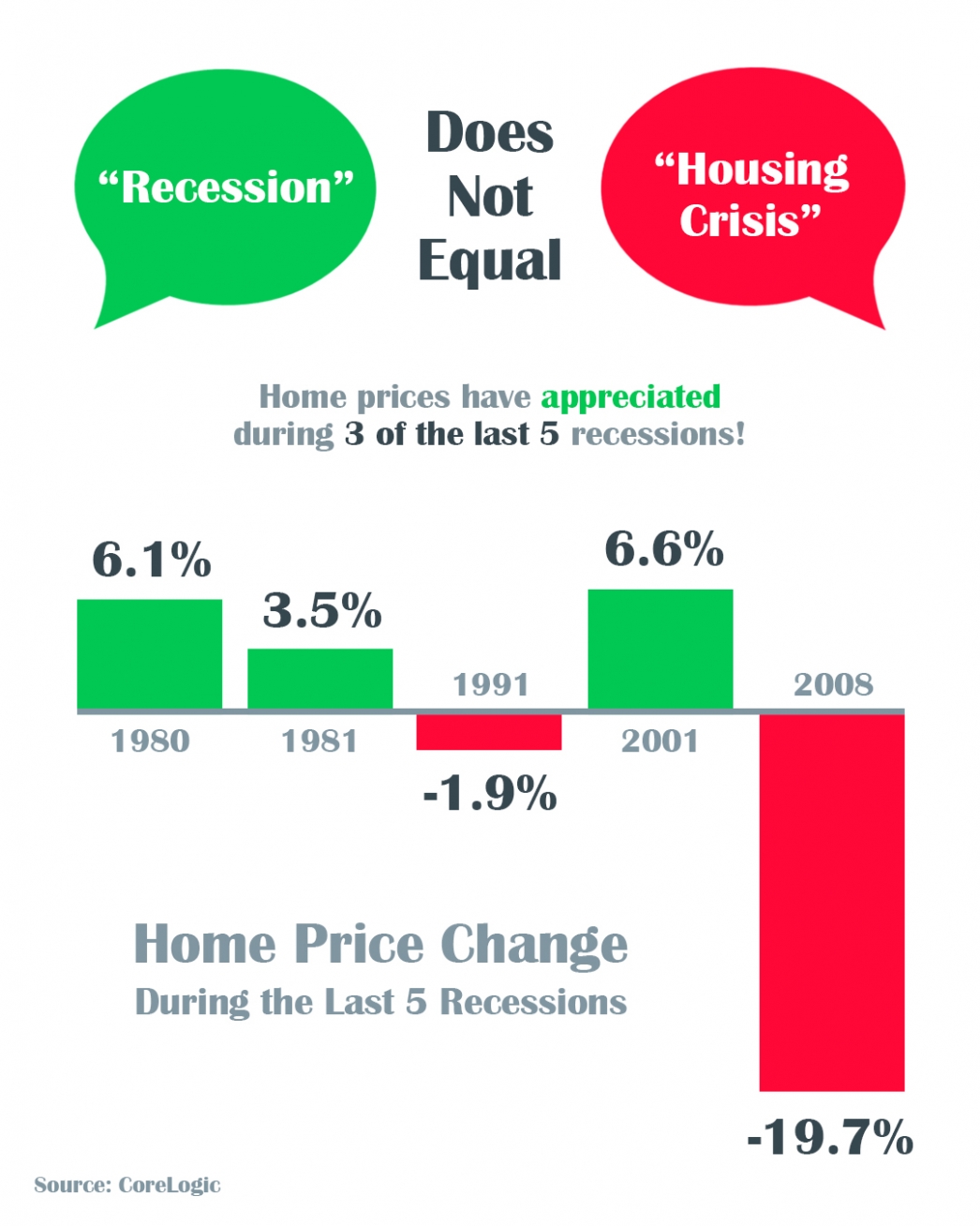

Interest rates can really affect your house payment....

This came through on my Keeping Current Matters feed. Click Here for the full article. Rates really are down now compared to historical levels. The chart above is based on a 200K loan, keep in mind you'll likely also be paying some monthly property taxes and insurance along with your monthly mortgage payment.

This came through on my Keeping Current Matters feed. Click Here for the full article. Rates really are down now compared to historical levels. The chart above is based on a 200K loan, keep in mind you'll likely also be paying some monthly property taxes and insurance along with your monthly mortgage payment.

Low interest rates can be good for both buyers and sellers, buyers save money, and sellers can more easily sell their home as higher rates can potentially scare a lot of buyers off.

Corona virus in Corvallis and Albany....

...hopefully not yet. So far there haven't been any reports of the new coronavirus popping up in our communities, but at some point it's bound to arrive.

Last night after reading an article about the importance of hand washing, and having a hand sanitizer available when you can't wash, I thought it might be wise to pick up a bottle for in the car. I'm pretty good about hand washing, it's the touching the nose, mouth or eyes inadvertently after an accidental exposure that are my possible concern. Looks as though I'm not the only one... Winco, Walmart Neighborhood Market, Market of Choice, BiMart and the north Safeway in Corvallis were all out of hand sanitizers with an alcohol base. I did pick up a small bottle this morning after the shelves were restocked.

From what I've read, for times you can't wash your hands with soap and water, they're recommending a hand sanitizer with 60-70% by volume ethyl alcohol to be effective in stopping the virus. If you decide to pick some up and the stores are out there is another option... DIY it. Apparently you can just mix isopropyl alcohol and aloe vera gel, one part aloe vera gel to two parts of rubbing alcohol and you'll end up with the necessary alcohol while the aloe vera protects your skin from damage from the alcohol. Do a little googling, there's a bunch of recipes, just note that the ones that recommend vodka or less than a two to one mix of alcohol to aloe might not be strong enough to do the job.

Note: I'm not trying to panic anyone, and I'm not panicky about this threat, it's not ebola (which kills 4 in 10 that get it). As of last night there are 6 deaths in the country from this virus while it is estimated that 18,000+ have died in the US from the flu so far this flu season (61,000 died two flu seasons back). People seem to be much much more aware of this threat, and that's a good thing, because it could potentially get very bad if it gets out of control as it is more lethal than the common flu. Hopefully with everyone taking precautions breakouts will be somewhat limited.

Stay healthy!

Steve

Last night after reading an article about the importance of hand washing, and having a hand sanitizer available when you can't wash, I thought it might be wise to pick up a bottle for in the car. I'm pretty good about hand washing, it's the touching the nose, mouth or eyes inadvertently after an accidental exposure that are my possible concern. Looks as though I'm not the only one... Winco, Walmart Neighborhood Market, Market of Choice, BiMart and the north Safeway in Corvallis were all out of hand sanitizers with an alcohol base. I did pick up a small bottle this morning after the shelves were restocked.

From what I've read, for times you can't wash your hands with soap and water, they're recommending a hand sanitizer with 60-70% by volume ethyl alcohol to be effective in stopping the virus. If you decide to pick some up and the stores are out there is another option... DIY it. Apparently you can just mix isopropyl alcohol and aloe vera gel, one part aloe vera gel to two parts of rubbing alcohol and you'll end up with the necessary alcohol while the aloe vera protects your skin from damage from the alcohol. Do a little googling, there's a bunch of recipes, just note that the ones that recommend vodka or less than a two to one mix of alcohol to aloe might not be strong enough to do the job.

Note: I'm not trying to panic anyone, and I'm not panicky about this threat, it's not ebola (which kills 4 in 10 that get it). As of last night there are 6 deaths in the country from this virus while it is estimated that 18,000+ have died in the US from the flu so far this flu season (61,000 died two flu seasons back). People seem to be much much more aware of this threat, and that's a good thing, because it could potentially get very bad if it gets out of control as it is more lethal than the common flu. Hopefully with everyone taking precautions breakouts will be somewhat limited.

Stay healthy!

Steve

Saturday, February 29, 2020

The bucks have dropped their antlers....

This group of bucks is sitting in our yard this morning. They seem to have all the viewing angles covered.

Over the course of the last 5-6 weeks or so the bucks in the neighborhood have been dropping their horns. We've been trying to keep an eye out in the yard for horns, we've managed to find a few over the years. If you don't get them right away the squirrels find them and start chewing them up pretty well.

Later,

Steve

Over the course of the last 5-6 weeks or so the bucks in the neighborhood have been dropping their horns. We've been trying to keep an eye out in the yard for horns, we've managed to find a few over the years. If you don't get them right away the squirrels find them and start chewing them up pretty well.

Later,

Steve

Thursday, February 27, 2020

Building wealth through home ownership? Here's some recent information...

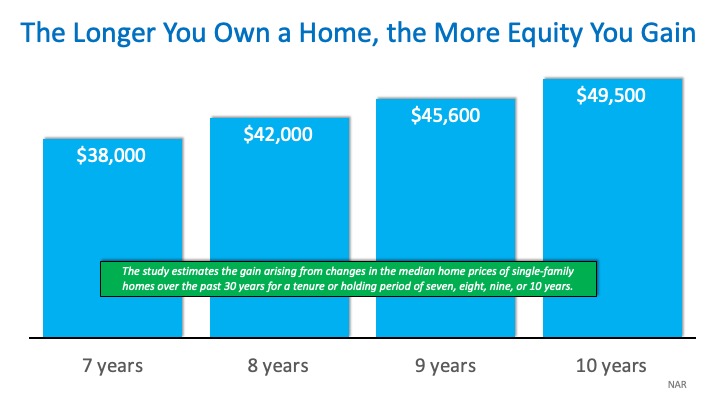

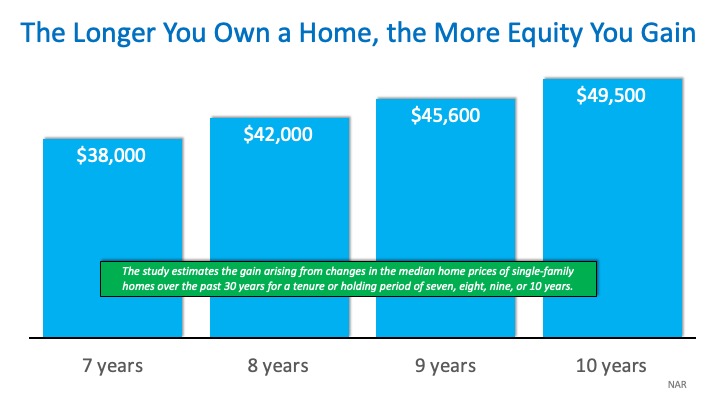

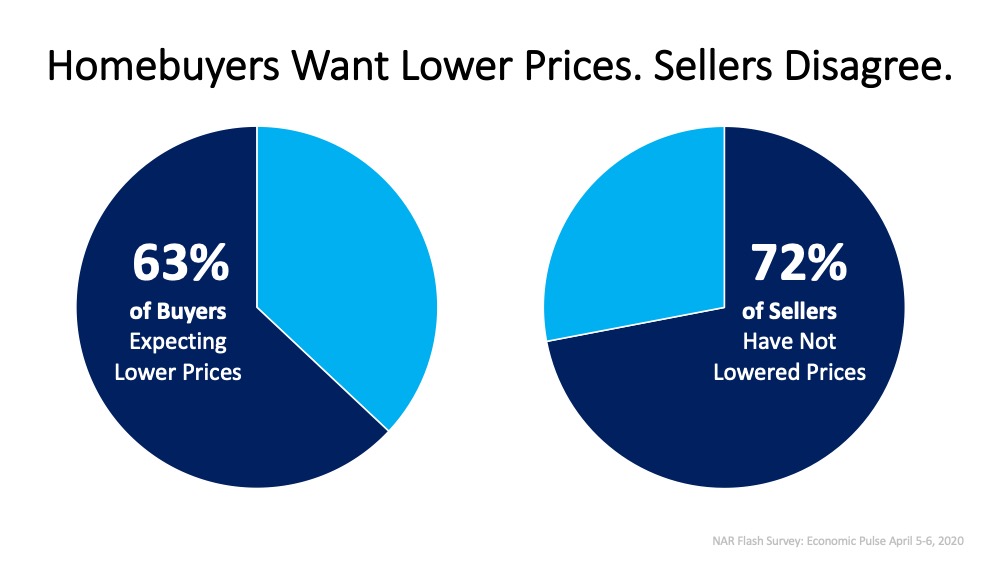

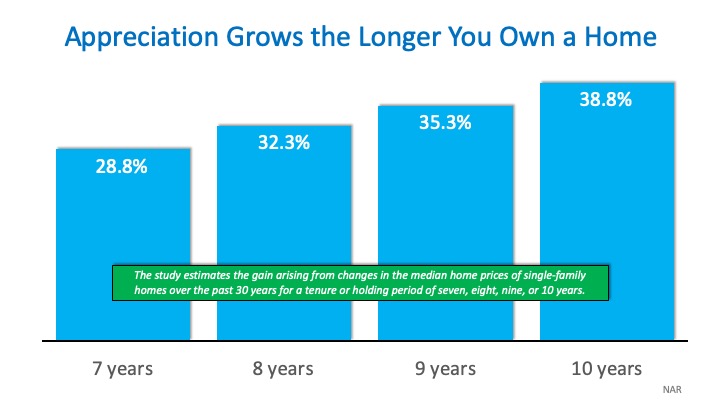

How Much “Housing Wealth” Can You Build in a Decade?

Earlier this month, the National Association of Realtors (NAR) released a special study titled Single-Family Home Price Gains by Years of Tenure. The study estimates median home price appreciation over the last 30 years based on the length of homeownership.

Below are three graphs depicting the most important data revealed in the study.

How much have home prices increased?

One of the first measures of the financial benefits of homeownership is the net worth (in the form of equity) an owner can build over time. The study showed the average increase in home values based on how long homeowners stayed in a home.

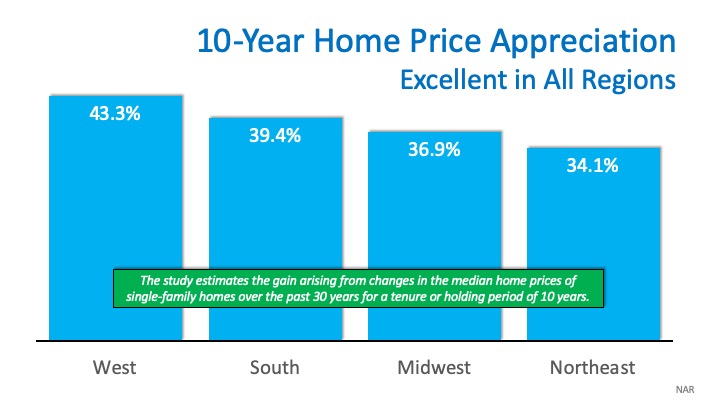

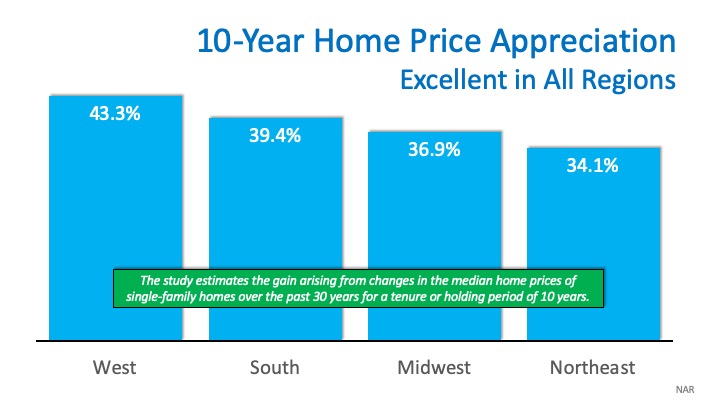

What was the percentage of appreciation?

Was this appreciation consistent throughout the country?

Today, when we think of markets that have done well over the last decade, we have a tendency to think about San Francisco, San Diego, Seattle, and other West Coast cities. Though it is true the West Region showed the highest price growth over the last three decades, we can see how every region of the country did quite well in ten-year increments: This data validates the claim that homeownership is great for building wealth. The importance of this information was highlighted in the study’s first sentence:

This data validates the claim that homeownership is great for building wealth. The importance of this information was highlighted in the study’s first sentence:

This data validates the claim that homeownership is great for building wealth. The importance of this information was highlighted in the study’s first sentence:

This data validates the claim that homeownership is great for building wealth. The importance of this information was highlighted in the study’s first sentence:“Homeownership is an important source of wealth creation, enabling current homeowners and succeeding generations to move up the economic ladder.”

Bottom Line

Homeownership has many financial and non-financial benefits. The accumulation of “housing wealth” through increased equity is a major one. If you’re thinking of buying a home for the first time or moving up to your dream home, the sooner you make the move, the sooner your net worth will begin to grow.

Price can affect how fast your home sells, here's some thoughts on house pricing...

-

The Ins and Outs of Setting a Price for Your Home

It’s a big decision with a lot of factors, but don’t worry — you have backup. Read

Visit houselogic.com for more articles like this.

Copyright 2020 NATIONAL ASSOCIATION OF REALTORS®

Pricing a home isn't quite as easy as going online and checking on one of the major real estate websites for the estimated price and calling it a day. I just googled my address and found multiple websites that had estimates spread well over a 100K range depending on the site. That's a lot of wiggle room, I felt one site that I looked at today was pretty darned spot on for TODAY (it can change fast) and it was literally 50-60K off. both high or low, of several others. Most online estimates are based on a dollars per square foot formula and have no clue as to condition, build quality, updating, etc. Realtors can really help narrow down your price. I'm happy to help you with the price of homes in the Corvallis and Albany area.

Monday, February 24, 2020

Sunday, February 23, 2020

Thursday, February 20, 2020

Wednesday, February 19, 2020

How much can a mortgage change at different interest rates?

Basically, the higher your interest rate goes, the more your mortgage is going to run. This graphic compares a 250k mortgage payment at historic rates versus today 's (more or less, it can change daily) rates.

Tuesday, February 18, 2020

There are some financial advantages to buying a home rather than renting...

The Overlooked Financial Advantages of Homeownership

There are many clear financial benefits to owning a home: increasing equity, building net worth, growing appreciation, and more. If you’re a renter, it’s never too early to make a plan for how homeownership can propel you toward a stronger future. Here’s a dive into three often-overlooked financial benefits of homeownership and how preparing for them now can steer you in the direction of greater stability, savings, and predictability.

1. You Won’t Always Have a Monthly Housing Payment

According to a recent article by the National Association of Realtors (NAR):

“If you’ve been a lifelong renter, this may sound like a foreign concept, but believe it or not, one day you won’t have a monthly housing payment. Unlike renting, you will eventually pay off your mortgage and your monthly payments will be funding other (possibly more fun) things.”

As a homeowner, someday you can eliminate the monthly payment you make on your house. That’s a huge win and a big factor in how homeownership can drive stability and savings in your life. As soon as you buy a home, your monthly housing costs will begin to work for you as forced savings, coming in the form of equity. As you build equity and grow your net worth, you can continue to reinvest those savings into your future, maybe even by buying that next dream home. The possibilities are truly endless.

2. Homeownership Is a Tax Break

One thing people who have never owned a home don’t always think about are the tax advantages of homeownership. The same piece states:

“Both the interest and property tax portion of your mortgage is a tax deduction. As long as the balance of your mortgage is less than the total price of your home, the interest is 100% deductible on your tax return.”

Whether you’re living in your first home or your fifth, it’s a huge financial advantage to have some tax relief tied to the interest you pay each year. It’s one thing you definitely don’t get when you’re renting. Be sure to work with a tax professional to get the best possible benefits on your annual return.

3. Monthly Housing Costs Are Predictable

A third item noted in the article is how monthly costs become more predictable with homeownership:

“As a homeowner, your monthly costs are most likely based on a fixed-rate mortgage, which allows you to budget your finances over a long period of time, unlike the unpredictability of renting.”

With a mortgage, you can keep your monthly housing costs steady and predictable. Rental prices have been skyrocketing since 2012, and with today’s low mortgage rates, it’s a great time to get more for your money when purchasing a home. If you want to lock-in your monthly payment at a low rate and have a solid understanding of what you’re going to spend in your mortgage payment each month, buying a home may be your best bet.

Bottom Line

If you’re ready to start feeling the benefits of stability, savings, and predictability that come with owning a home, let’s get together to determine if buying a home sooner rather than later is right for you.

Monday, February 17, 2020

Thinking of investing in a fixer upper house to flip or rent....

-

6 Simple Steps to Assess the Real Cost of a Fixer-Upper House

This will help you figure out how much to offer for a fixer-upper. Read

Visit houselogic.com for more articles like this.

Copyright 2020 NATIONAL ASSOCIATION OF REALTORS®

Sunday, February 16, 2020

Should I wait before buying a house....

This video is actually from last year, but prices are still rising and the video still applies...

Some of the best reasons to wait on a home purchase are paying down debt and building up a down payment, but waiting to buy because prices may go down backfires quite often. If you are paying rent, perhaps it's worth your while to compare it to what a house will cost to buy. There are low to no down payment options available to many people nowadays, maybe it's time to think about purchasing a new home. If you have questions, contact me and we can work the numbers and see if home buying is something that works for you.

Some of the best reasons to wait on a home purchase are paying down debt and building up a down payment, but waiting to buy because prices may go down backfires quite often. If you are paying rent, perhaps it's worth your while to compare it to what a house will cost to buy. There are low to no down payment options available to many people nowadays, maybe it's time to think about purchasing a new home. If you have questions, contact me and we can work the numbers and see if home buying is something that works for you.

Saturday, February 15, 2020

Do you need a fan in your bathroom?

-

Everyone Wants This In Their Bathroom! What a Change It Makes!

The air will smell (much!) sweeter, paint will last longer, and mold will grow slower — or not at all. Now are you ready for a bathroom exhaust fan installation? Read

Visit houselogic.com for more articles like this.

Copyright 2020 NATIONAL ASSOCIATION OF REALTORS®

Friday, February 14, 2020

Should I wait to sell my house?

The #1 Reason to List Your House Right Now

The success of the U.S. residential real estate market, like any other market, is determined by supply and demand. This means we need to look at how many potential purchasers are in the market versus the number of houses that are available to buy. With early 2020 housing data now rolling in, it’s quite evident there are two big stories impacting this year’s residential real estate market:

1. Buyer demand is already extremely strong

2. Housing supply is at a historically low level

2. Housing supply is at a historically low level

Demand

ShowingTime is a firm that compiles data from property showings scheduled across the country. The latest ShowingTime Showing Index reveals how showings have increased in each of the country’s four regions for five months in a row.

Supply

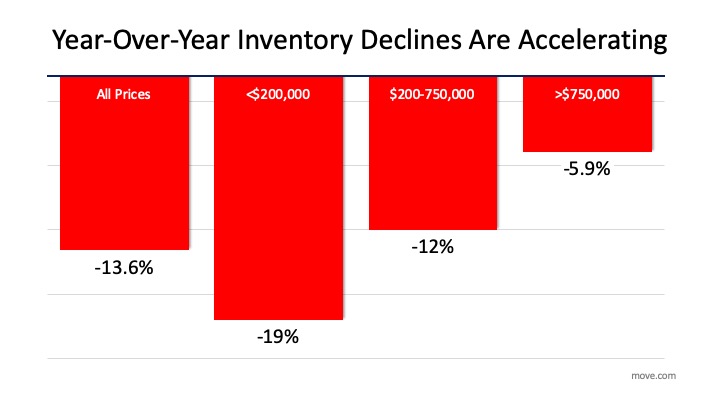

Move.com also just released information indicating that the number of homes currently for sale has declined rapidly and now sits at the lowest level in almost a decade. They explained,

“National housing inventory declined 13.6 percent in January, the steepest year-over-year decrease in more than 4 years, pushing the supply of for sale homes in the U.S. to its lowest level since realtor.com began tracking the data in 2012.”

In response to these numbers, Danielle Hale, Chief Economist at realtor.com, said,

"Homebuyers took advantage of low mortgage rates and stable listing prices to drive sales higher at the end of 2019, further depleting the already limited inventory of homes for sale. With fewer homes coming up for sale, we've hit another new low of for sale-listings in January."

The decrease in inventory impacted every price range, too. Here’s a graph showing the data released by move.com:

Bottom Line

Since there’s a historic shortage of homes for sale, putting your home on the market today could drive an excellent price and give you additional negotiating leverage when selling your house. Let’s get together to determine if listing your house now is your best move.

Subscribe to:

Posts (Atom)

Link:

Link: