STEVE FRISBIE - CORVALLIS AND ALBANY REAL ESTATE AGENT

I'm back to Corvallis, Oregon for a new adventure after 14 years as a scuba instructor/Coast Guard licensed boat Captain/dive company owner in Kona Hawaii. This blog will be a combination of my real estate work life and my personal adventures in Corvallis, Albany and the surrounding world. Feel free to join me on these new journeys.

Keller Williams Mid Willamette real estate agent

Steve Frisbie is a licensed real estate agent in the State of Oregon. REALTOR®. Equal Opportunity Housing Provider. Each office is independently owned and operated.

Wednesday, January 27, 2021

Harbor Freight Opens In Corvallis Oregon

Harbor Frieght just opened yesterday up in the old Albertsons location on the corner of Kings and Circle. I did a quick walk-through, lots of tools to look at, I'll probably be adding a few things to my growing collection over time.

Tuesday, June 16, 2020

Is the economic recovery already happening?

I hope so. It seems that the stock market has recovered most of it's losses and people are getting back to work. I hope everyone is recovering, it's been a difficult time for many. Here's to good times ahead. Thought I'd pass this along...

Friday, May 22, 2020

Now may be a great time to refinance your home....

Interest rates are so low my wife and I had to bite... and refinance our home. We had done a re-fi a while back to get some money for a something we wanted to do and unfortunately it was while rates had risen a bit. Today the rates are very low and we had to take the opportunity to save some money - we saved about a percent and a half off of our old rate. A percent and a half doesn't sound like much, but in our case it's huge, we're talking hundreds of dollars a month - well worth the minimal effort and time it took to refinance.

If you have a relatively high interest rate on you home loan, it may be worth your while to make a couple of phone calls or at least go online and inquire at a couple of mortgage loan sites. They'll likely call you back quickly. What we found was it's worthwhile checking with a few places... your bank or credit union, a local mortgage company or two and perhaps an online mortgage place or two. We found that the rates they would give us varied, the ending APR they gave us varied, and the fees they charged varied quite a bit.

Keep in mind, you'll need to run the numbers before committing. Depending on your credit rating, the size of your loan, time left on it, rate on the original loan, what the fees will run on the refinancing, and a couple other factors, it may not be worthwhile refinancing... or it could save you a lot of money. You'll need to run the numbers, but if it works out in your favor you should consider it. In our case what we're saving will pay for all of our refinancing costs in about a half a year, the rest is bonus money we can put back into the house , paying off the loan earlier, investing towards retirement or just plain fun. It was well worth it for us.

For those of you who are considering taking out a home loan to purchase a home... Now is a great time compared to historical rates. There's a chance rates could go either way from here, but current rates are still very low, which could mean lower payments or more house for the same payment compared to earlier dates... in most cases it's a win.

Interest Rates Hover Near Historic All-Time Lows [INFOGRAPHIC]

![Interest Rates Hover Near Historic All-Time Lows [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/05/21093649/20200522-MEM-1046x837.png)

Some Highlights

- Mortgage interest rates have dropped considerably this spring and are hovering at a historically low level.

- Locking in at a low rate today could save you thousands of dollars over the lifetime of your home loan.

- Let’s connect to determine the best way to position yourself for a move in today’s market.

Went for a hike out at Finley Wildlife Refuge last weekend...

Sunday my wife and I decided to go for a little bit of a walk out at the Finley Wildlife Refuge about 10-15 minutes south of Corvallis. We'd never actually been there before so it was great fun visiting a new spot.

We entered from the Bellfountain Road entrance at Finley Refuge Road. They have the road gated off for now, I believe it's a Covid-19 shutdown thing as the visitor center was closed, but you're still welcome to walk the myriad of trails they have in there.

We chose to take the Mill Hill Loop trail, which from this entrance is the first trail we came across. The entire loop from the entrance and back is right at about 4 miles with about a 450 foot elevation change overall. From the visitor's center I believe it's about a mile shorter of a hike. I'd say it's an easy to moderate incline in spots, nothing real difficult, otherwise it's a relatively level hike for the bulk of it.

We chose to take the Mill Hill Loop trail, which from this entrance is the first trail we came across. The entire loop from the entrance and back is right at about 4 miles with about a 450 foot elevation change overall. From the visitor's center I believe it's about a mile shorter of a hike. I'd say it's an easy to moderate incline in spots, nothing real difficult, otherwise it's a relatively level hike for the bulk of it.We'll definitely be going back, there's several hiking trails to explore!

Thursday, May 14, 2020

Here's some thoughts on how home sales will shake down once the Covid-19 shutdown restrictions loosen....

Driving around Corvallis it does seem like there are fewer houses coming on the market right now, but I'm also seeing a lot of signs coming down.... people are still buying. It'll be interesting to see how the local May sales stats look. Here's a video to check out. If you are thinking about making a move in the future, give me a text or a call. I'm happy to help if you have any questions.

Looks like people are starting to shift to moving to less populated areas...

A Surprising Shift to the ‘Burbs May Be on the Rise

While many people across the U.S. have traditionally enjoyed the perks of an urban lifestyle, some who live in more populated city limits today are beginning to rethink their current neighborhoods. Being in close proximity to everything from the grocery store to local entertainment is definitely a perk, especially if you can also walk to some of these hot spots and have a short commute to work. The trade-off, however, is that highly populated cities can lack access to open space, a yard, and other desirable features. These are the kinds of things you may miss when spending a lot of time at home. When it comes to social distancing, as we’ve experienced recently, the newest trend seems to be around re-evaluating a once-desired city lifestyle and trading it for suburban or rural living.

George Ratiu, Senior Economist at realtor.com notes:

“With the re-opening of the economy scheduled to be cautious, the impact on consumer preferences will likely shift buying behavior…consumers are already looking for larger homes, bigger yards, access to the outdoors and more separation from neighbors. As we move into the recovery stage, these preferences will play an important role in the type of homes consumers will want to buy. They will also play a role in the coming discussions on zoning and urban planning. While higher density has been a hallmark of urban development over the past decade, the pandemic may lead to a re-thinking of space allocation.”

The Harris Poll recently surveyed 2,000 Americans, and 39% of the respondents who live in urban areas indicated the COVID-19 crisis has caused them to consider moving to a less populated area. Today, moving outside the city limits is also more feasible than ever, especially as Americans have quickly become more accustomed to – and more accepting of – remote work. According to the Pew Research Center, access to the Internet has increased significantly in rural and suburban areas, making working from home more accessible. The number of people working from home has also spiked considerably, even before the pandemic came into play this year.

Today, moving outside the city limits is also more feasible than ever, especially as Americans have quickly become more accustomed to – and more accepting of – remote work. According to the Pew Research Center, access to the Internet has increased significantly in rural and suburban areas, making working from home more accessible. The number of people working from home has also spiked considerably, even before the pandemic came into play this year.

Today, moving outside the city limits is also more feasible than ever, especially as Americans have quickly become more accustomed to – and more accepting of – remote work. According to the Pew Research Center, access to the Internet has increased significantly in rural and suburban areas, making working from home more accessible. The number of people working from home has also spiked considerably, even before the pandemic came into play this year.

Today, moving outside the city limits is also more feasible than ever, especially as Americans have quickly become more accustomed to – and more accepting of – remote work. According to the Pew Research Center, access to the Internet has increased significantly in rural and suburban areas, making working from home more accessible. The number of people working from home has also spiked considerably, even before the pandemic came into play this year.Bottom Line

If you have a home in the suburbs or a rural area, you may see an increasing number of buyers looking for a property like yours. If you’re thinking of buying and don’t mind a commute to work for the well-being of your family, you may want to consider looking at homes for sale outside the city. Let’s connect today to discuss the options available in our area.

Monday, April 27, 2020

Today’s Expert Insight on the Housing Market [INFOGRAPHIC]

![Today’s Expert Insight on the Housing Market [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/04/23123713/20200424-MEM-EN-1046x1308.jpg)

Some Highlights

- According to Lawrence Yun, Chief Economist at NAR, home prices are forecasted to rise.

- Results from the Existing Home Sales Report note that home sales declined in March due to the coronavirus, but prices are still strong.

- Let’s connect so you can better understand your home’s value today.

Tuesday, April 21, 2020

Here's a little video on house values and recessions...

I wish I had a little crystal ball so I could tell exactly will happen to home values over the next few months, but it may not be anything like the price drops back in 2008. In three of the last 5 recessions home prices actually went up.

Coming into 2008 there were plenty of homes on the market and plenty of new homes being built, the home equity loan market was much more active than it is now, and there were lots of BAD loans out there. After that crisis loan programs tightened up, new housing starts dropped to realistic and now there's actually less inventory homes out there for sale. Hopefully home values will continue to grow into the future.

If you have any questions about real estate, feel free to get in touch with me, I'm always happy to talk shop and give out free information. www.propertybysteve.com

Coming into 2008 there were plenty of homes on the market and plenty of new homes being built, the home equity loan market was much more active than it is now, and there were lots of BAD loans out there. After that crisis loan programs tightened up, new housing starts dropped to realistic and now there's actually less inventory homes out there for sale. Hopefully home values will continue to grow into the future.

If you have any questions about real estate, feel free to get in touch with me, I'm always happy to talk shop and give out free information. www.propertybysteve.com

Saturday, April 18, 2020

Homes are still selling in Corvallis and Albany....

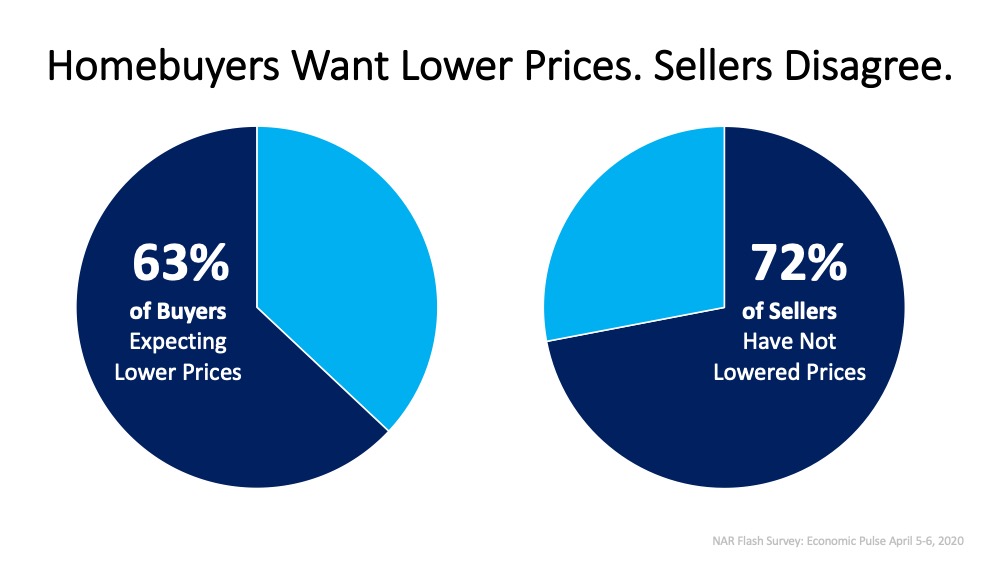

Today’s Homebuyers Want Lower Prices. Sellers Disagree.

The uncertainty the world faces today due to the COVID-19 pandemic is causing so many things to change. The way we interact, the way we do business, even the way we buy and sell real estate is changing. This is a moment in time that’s even sparking some buyers to search for a better deal on a home. Sellers, however, aren’t offering a discount these days; they’re holding steady on price.

According to the most recent NAR Flash Survey (a survey of real estate agents from across the country), agents were asked the following two questions:

1. “Have any of your sellers recently reduced their price to attract buyers?”

Their answer: 72% said their sellers have not lowered prices to attract buyers during this health crisis.

2. “Are home buyers expecting lower prices now?”

Their answer: 63% of agents said their buyers were looking for a price reduction of at least 5%.

What We Do Know

In today’s market, with everything changing and ongoing questions around when the economy will bounce back, it’s interesting to note that some buyers see this time as an opportunity to win big in the housing market. On the other hand, sellers are much more confident that they will not need to reduce their prices in order to sell their homes. Clearly, there are two different perspectives at play.

Bottom Line

If you’re a buyer in today’s market, you might not see many sellers lowering their prices. If you’re a seller and don’t want to lower your price, you’re not alone. If you have questions on how to price your home, let’s connect today to discuss your real estate needs and next steps.

Wednesday, April 1, 2020

Fitton Green Natural Area on the edge of Corvallis is still open for now....

I decided to get out of the house (social distancing means working from home for the most part) and go for a short walk today, wanted to get in 15 minutes or so of uphill walking. I decided to check out the Fitton Green Natura Area to see if it is still open and how many people were out and about. It's been kind of wet so when I arrived there were no other cars in the lot, there was one car there when I finished my little walk.

It was spitting a little of slush when I went and was basically quite foggy so I didn't take any landscape style photos. I haven't been there very many times so I don't really know the trails, but the one I've been on, the Allen Throop Loop, provides great open views of the area on most days, visibility was limited today. Hopefully the county will be able to continue to make places like this available to people as long as they continue practicing social distancing. It's nice to have the option to get out in a more natural setting.

Stay healthy,

Steve

Tuesday, March 31, 2020

Refinance rates are very low, should I refinance my house now?

Is Now a Good Time to Refinance My Home?

With interest rates hitting all-time lows over the past few weeks, many homeowners are opting to refinance. To decide if refinancing your home is the best option for you and your family, start by asking yourself these questions:

Why do you want to refinance?

There are many reasons to refinance, but here are three of the most common ones:

1. Lower Your Interest Rate and Payment: This is the most popular reason. Is your current interest rate higher than what’s available today? If so, it might be worth seeing if you can take advantage of the current lower rates.

2. Shorten the Term of Your Loan: If you have a 30-year loan, it may be advantageous to change it to a 15 or 20-year loan to pay off your mortgage sooner rather than later.

3. Cash-Out Refinance: You might have enough equity to cash out and invest in something else, like your children’s education, a business venture, an investment property, or simply to increase your cash reserve.

Once you know why you might want to refinance, ask yourself the next question:

How much is it going to cost?

There are fees and closing costs involved in refinancing, and The Lenders Network explains:

“As an example, let’s say your mortgage has a balance of $200,000. If you were to refinance that loan into a new loan, total closing costs would run between 2%-4% of the loan amount. You can expect to pay between $4,000 to $8,000 to refinance this loan.”

They also explain that there are options for no-cost refinance loans, but be on the lookout:

“A no-cost refinance loan is when the lender pays the closing costs for the borrower. However, you should be aware that the lender makes up this money from other aspects of the mortgage. Usually charging a slightly higher interest rate so they can make the money back.”

Keep in mind that, given the current market conditions and how favorable they are for refinancing, it can take a little longer to execute the process today. This is because many other homeowners are going this route as well. As Todd Teta, Chief Officer at ATTOM Data Solutions notes about recent mortgage activity:

“Refinancing largely drove the trend, with more than twice as many homeowners trading in higher-interest mortgages for cheaper ones than in the same period of 2018.”

Clearly, refinancing has been on the rise lately. If you’re comfortable with the up-front cost and a potential waiting period due to the high volume of requests, then ask yourself one more question:

Is it worth it?

To answer this one, do the math. Will it help you save money? How much longer do you need to own your home to break even? Will your current home meet your needs down the road? If you plan to stay for a few years, then maybe refinancing is your best move.

If, however, your current home doesn’t fulfill your needs for the next few years, you might want to consider using your equity for a down payment on a new home instead. You’ll still get a lower interest rate than the one you have on your current house, and with the equity you’ve already built, you can finally purchase the home you’ve been waiting for.

Bottom Line

Today, more than ever, it’s important to start working with a trusted real estate advisor. Whether you connect by phone or video chat, a real estate professional can help you understand how to safely navigate the housing market so that you can prioritize the health of your family without having to bring your plans to a standstill. Whether you’re looking to refinance, buy, or sell, a trusted advisor knows the best protocol as well as the optimal resources and lenders to help you through the process in this fast-paced world that’s changing every day.

Subscribe to:

Comments (Atom)