I'm back to Corvallis, Oregon for a new adventure after 14 years as a scuba instructor/Coast Guard licensed boat Captain/dive company owner in Kona Hawaii. This blog will be a combination of my real estate work life and my personal adventures in Corvallis, Albany and the surrounding world. Feel free to join me on these new journeys.

Keller Williams Mid Willamette real estate agent

Steve Frisbie is a licensed real estate agent in the State of Oregon. REALTOR®. Equal Opportunity Housing Provider. Each office is independently owned and operated.

Saturday, February 29, 2020

The bucks have dropped their antlers....

Over the course of the last 5-6 weeks or so the bucks in the neighborhood have been dropping their horns. We've been trying to keep an eye out in the yard for horns, we've managed to find a few over the years. If you don't get them right away the squirrels find them and start chewing them up pretty well.

Later,

Steve

Thursday, February 27, 2020

Building wealth through home ownership? Here's some recent information...

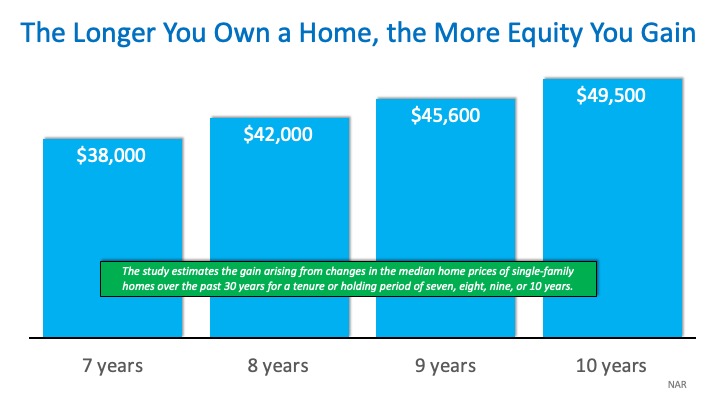

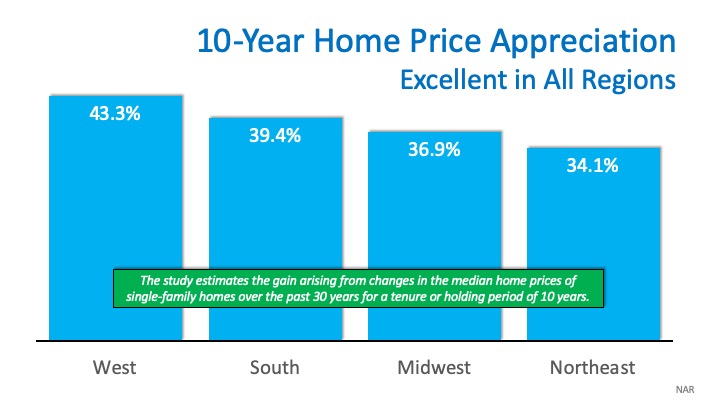

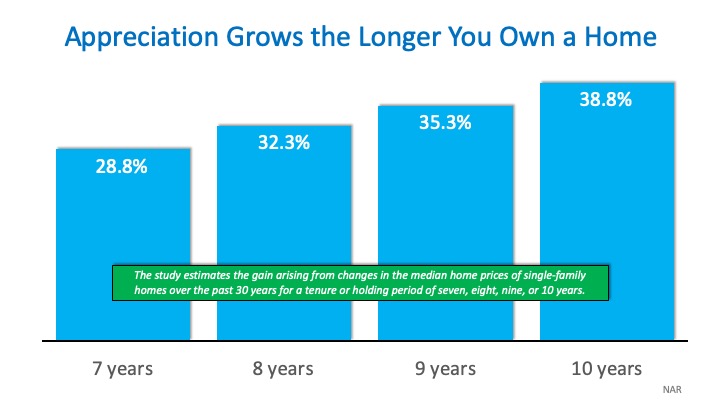

How Much “Housing Wealth” Can You Build in a Decade?

How much have home prices increased?

What was the percentage of appreciation?

Was this appreciation consistent throughout the country?

This data validates the claim that homeownership is great for building wealth. The importance of this information was highlighted in the study’s first sentence:

This data validates the claim that homeownership is great for building wealth. The importance of this information was highlighted in the study’s first sentence:“Homeownership is an important source of wealth creation, enabling current homeowners and succeeding generations to move up the economic ladder.”

Bottom Line

Price can affect how fast your home sells, here's some thoughts on house pricing...

-

The Ins and Outs of Setting a Price for Your Home

It’s a big decision with a lot of factors, but don’t worry — you have backup. Read

Monday, February 24, 2020

Sunday, February 23, 2020

Thursday, February 20, 2020

Wednesday, February 19, 2020

How much can a mortgage change at different interest rates?

Tuesday, February 18, 2020

There are some financial advantages to buying a home rather than renting...

The Overlooked Financial Advantages of Homeownership

1. You Won’t Always Have a Monthly Housing Payment

“If you’ve been a lifelong renter, this may sound like a foreign concept, but believe it or not, one day you won’t have a monthly housing payment. Unlike renting, you will eventually pay off your mortgage and your monthly payments will be funding other (possibly more fun) things.”

2. Homeownership Is a Tax Break

“Both the interest and property tax portion of your mortgage is a tax deduction. As long as the balance of your mortgage is less than the total price of your home, the interest is 100% deductible on your tax return.”

3. Monthly Housing Costs Are Predictable

“As a homeowner, your monthly costs are most likely based on a fixed-rate mortgage, which allows you to budget your finances over a long period of time, unlike the unpredictability of renting.”

Bottom Line

Monday, February 17, 2020

Thinking of investing in a fixer upper house to flip or rent....

-

6 Simple Steps to Assess the Real Cost of a Fixer-Upper House

This will help you figure out how much to offer for a fixer-upper. Read

Sunday, February 16, 2020

Should I wait before buying a house....

Some of the best reasons to wait on a home purchase are paying down debt and building up a down payment, but waiting to buy because prices may go down backfires quite often. If you are paying rent, perhaps it's worth your while to compare it to what a house will cost to buy. There are low to no down payment options available to many people nowadays, maybe it's time to think about purchasing a new home. If you have questions, contact me and we can work the numbers and see if home buying is something that works for you.

Saturday, February 15, 2020

Do you need a fan in your bathroom?

-

Everyone Wants This In Their Bathroom! What a Change It Makes!

The air will smell (much!) sweeter, paint will last longer, and mold will grow slower — or not at all. Now are you ready for a bathroom exhaust fan installation? Read

Visit houselogic.com for more articles like this.

Copyright 2020 NATIONAL ASSOCIATION OF REALTORS®

Friday, February 14, 2020

Should I wait to sell my house?

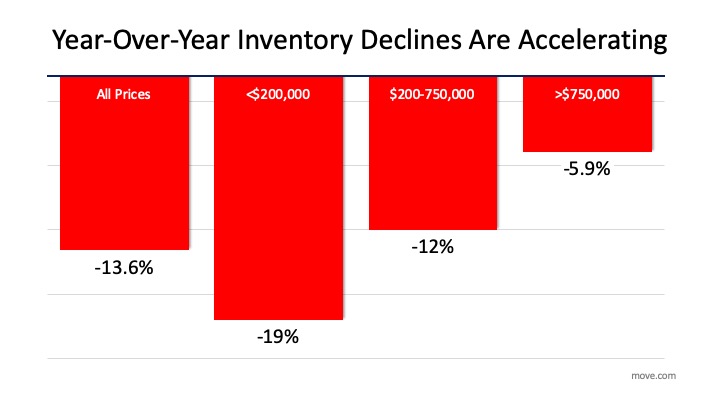

The #1 Reason to List Your House Right Now

2. Housing supply is at a historically low level

Demand

Supply

“National housing inventory declined 13.6 percent in January, the steepest year-over-year decrease in more than 4 years, pushing the supply of for sale homes in the U.S. to its lowest level since realtor.com began tracking the data in 2012.”

"Homebuyers took advantage of low mortgage rates and stable listing prices to drive sales higher at the end of 2019, further depleting the already limited inventory of homes for sale. With fewer homes coming up for sale, we've hit another new low of for sale-listings in January."

Bottom Line

Here are some inexpensive garage storage ideas....

-

14 Garage Organization Ideas Under $50

Easy-to-afford solutions for your tools, sporting and seasonal gear (so you’ll have room for your car, too). Read

Visit houselogic.com for more articles like this.

Copyright 2020 NATIONAL ASSOCIATION OF REALTORS®

Thursday, February 13, 2020

Here's some statistics on Corvallis and North Albany home sales in 2019...

Tuesday, February 11, 2020

How do I sell my home quickly?

This video shares some good ideas on selling a home quickly.

Access - Many buyers will be wary if they can not get into a property. Access can begin with the MLS listing, get as many professional photos (I work with a photographer) as the MLS allows on the listing, and ensure the listing is complete and accurate. After that, the easier it is to show a home, the easier it'll be to get buyers through the front door. Homes can and do get under contract without pre-offer showings on occasion, but homes with good access typically generate more interest more quickly.

Staging - Staging doesn't necessarily have to go all out in our market right now, but clean and clutter free will do a lot to help a home sell. On slower moving or high end properties, proper staging can make a big difference. Clean is a priority for any home. I'm happy to take look at homes and provide suggestions to help them sell quicker. I also have access to professional home stagers if needed.

Price to sell - This doesn't mean you need to give away the farm, but you should be pricing your property at or just slightly below (in hopes of generating multiple offers) market price if you want it to move. Buyers will generally not pay above market price for a property, while many sellers will have emotional attachments to their property and have a tough time letting a property go for what is market price at that moment. Market prices can change fast these days, and online pricing resources aren't necessarily spot on, in some cases quite off, and being a local Realtor, I can help narrow down the price correctly. Even if a seller is willing to listen to offers, properties priced too high can actually scare off offers, and if a home that is overpriced sits too long, a price drop may not help it generate a lot of new buyer activity, so it's best to be priced in the correct range from the get-go.

My goal is to get you the best possible price, as quickly as possible.

Steve

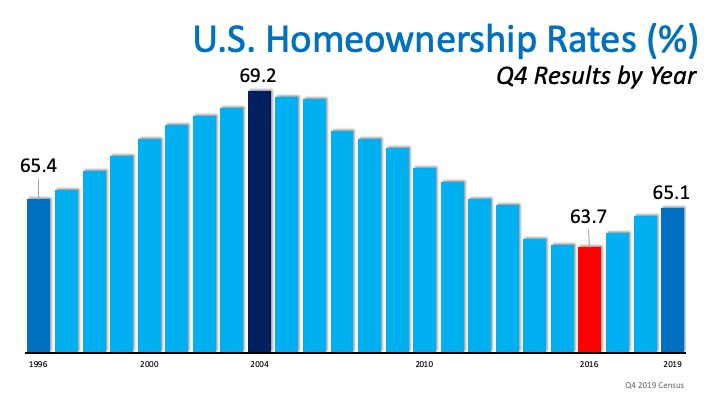

Looks like homeownership rates are back on the rise....

Homeownership Rate on the Rise to a 6-Year High

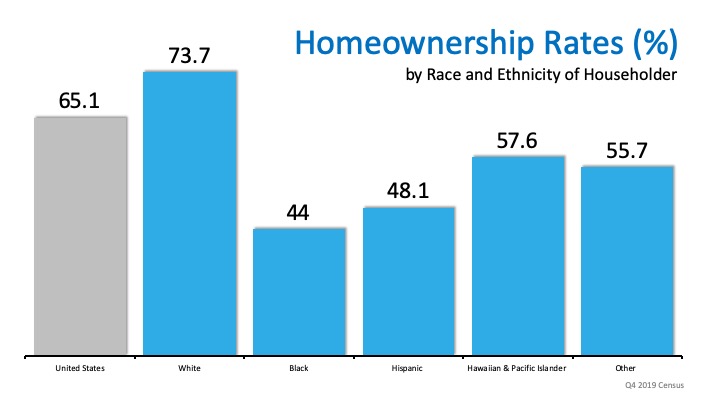

Regardless of the lack of inventory on the market, the U.S. homeownership rate has climbed to a 6-year high. The United States Census Bureau reported that it increased to 65.1% in the fourth quarter of 2019, representing the highest level in the past six years. See the graph below:This increase does not come as a surprise. According to realtor.com,

Regardless of the lack of inventory on the market, the U.S. homeownership rate has climbed to a 6-year high. The United States Census Bureau reported that it increased to 65.1% in the fourth quarter of 2019, representing the highest level in the past six years. See the graph below:This increase does not come as a surprise. According to realtor.com,“The largest cohort of the millennial generation turns 30-years-old in 2020 and they are hitting the housing market in full force. At the end of the fourth quarter of 2019, millennials made up the largest generational segment of homebuyers, growing their share of home purchase mortgages to 48 percent.”

“Homeownership is an even bigger goal for younger generations. Of those with savings, 41 percent of Gen Z and 40 percent of younger millennials are saving to buy a home.”

“The combination of very low mortgage rates, a strong economy and more positive financial market sentiment all point to home purchase demand continuing to rise over the next few months.”

“The homeownership rate for black Americans in 2019’s fourth quarter rose to 44%, a seven-year high, increasing from the record low it reached in 2019’s second quarter. The rate for Hispanic Americans was 48.1%, a two-year high, the Census data showed…The rate for white Americans was 73.7%, an eight-year high.”

Bottom Line

Monday, February 10, 2020

Sunday, February 9, 2020

Renting versus buying in Corvallis...

Here's a little story from my past... Back in the 80's I lived in a 5 bedroom house down near campus a bunch of us rented for $1100 a month from what I recall. I got to talking with the landlord and they said they were thinking about putting the house on the market for 72K.

Now interest rates were in the 14% range back in '84-'85 and even with interest rates that high (we have it real good now with current interest rates, it's a great time to be buying) it would have saved us a bit of money to buy the house. Of course, we were a bunch of college aged kids all planning on going our separate ways and couldn't swing it, but it was an interesting thought. Since I now have access to past listings I decided to look up the most recent sale, and that house sold in the mid-400s and was renting out at over 3K a month. Woulda,coulda, shoulda... anyways, I'm a firm believer that if you are planning on staying put for 5-6 years or more buying should be a strongly considered if you can make it happen.

Friday, February 7, 2020

Are first time buyers looking for existing homes or newly built homes.....

First-Time Buyers Are Searching for Existing Homes This Year

“Millennials are the most likely generation to be making plans to purchase a home within a year (19%), followed by Gen Z (13%) and Gen X (12%)…Prospective buyers in the youngest two generations are primarily first-time buyers: 88% of Gen Z buyers and 78% of Millennial buyers are reaching out to homeownership for the first time in their lives.”

“In terms of the type of home these prospective home buyers are interested in, 40% are looking to buy an existing home and 19% a newly-built home. The remaining 41% would buy either a new or existing home.”

Bottom Line

How much mortgage can I afford?

-

4 Tips to Determine How Much Mortgage You Can Afford

What’s a rule of thumb to determine how much mortgage you can afford? There’s no one rule, but these four tips will tell you. Read

Thursday, February 6, 2020

Homeowners are generally pretty happy to no longer be renting....

I'm not going to guarantee owning a home is going to make you happier, but if you are frustrated about paying someone else's mortgage while renting when you could pay your own mortgage and likely be building equity, let's talk.

Wednesday, February 5, 2020

Here's some thoughts on housing availability...

Where Have All the Houses Disappeared To?

“Total housing inventory at the end of December totaled 1.40 million units, down 14.6% from November and 8.5% from one year ago. Unsold inventory sits at a 3.0-month supply at the current sales pace, down from the 3.7-month figure recorded in both November and December 2018. Unsold inventory totals have dropped for seven consecutive months from year-ago levels, taking a toll on home sales.”

“The number of for-sale homes in the U.S. is at its lowest point in at least seven years, and the shortage appears poised to get worse before it gets better.”

“Inventory always decreases sharply in December as people take their homes off the market for the holidays. However, based on the data I've collected, this was the lowest level for inventory in at least three decades (the previous low was 1.43 million in December 1993).”

Why is inventory falling so dramatically? I thought the housing market had softened.

"A year ago, a combination of a government shutdown, stock market slump and mortgage rate spike caused a long-anticipated inventory rise. That supposed boom turned out to be a short-lived mirage as buyers came back into the market and more than erased the inventory gains. As a natural reaction, the recent slowdown in home values looks like it's set to reverse back to accelerating growth right as we head into home shopping season with demand outpacing supply."

What does this mean if you’re a homeowner thinking of selling?

Bottom Line

Tuesday, February 4, 2020

As wages have been rising and interest rates remain low, buying power is increasing....

What should I repair before selling my house......

-

7 Important Repairs to Make Before Selling A House

The most critical things to do to increase your home’s value before putting it on the market. Read

Visit houselogic.com for more articles like this.

Copyright 2020 NATIONAL ASSOCIATION OF REALTORS®

Here's some real estate statistics from Albany, Oregon from this January....

For the Corvallis statistics, click here.

Monday, February 3, 2020

Here's some basic potential pricing info on kitchen remodeling...

-

A Kitchen Remodel Worksheet to Help You Cut Costs

Find out how much it costs to remodel a kitchen, item by item, so you never spend more than you need to. Read

I figured this would be a great article to pass along. We keep thinking of things we'd like to do to our house and it's a decent reference for ideas.

Steve

Here's some Corvallis residential real estate sale statistics from January....

Thought I'd post the most recent stats passed along to me at work. These are taken from the Willamette Valley Multiple Listing Service. This is a bit busier winter than we had the last year. If you have any questions or real estate needs- text, call or email me and I'll be happy to help.

Some information on pre-approval for loans...

Three Reasons Why Pre-Approval Is the First Step in the 2020 Homebuying Journey

1. Gain a Competitive Advantage

2. Accelerate the Homebuying Process

3. Know What You Can Borrow and Afford

“It’s highly recommended that you work with your lender to get pre-approved before you begin house hunting. Pre-approval will tell you how much home you can afford and can help you move faster, and with greater confidence, in competitive markets.”

- Capacity: Your current and future ability to make your payments

- Capital or Cash Reserves: The money, savings, and investments you have that can be sold quickly for cash

- Collateral: The home, or type of home, that you would like to purchase

- Credit: Your history of paying bills and other debts on time

Link:

Link: