I'm back to Corvallis, Oregon for a new adventure after 14 years as a scuba instructor/Coast Guard licensed boat Captain/dive company owner in Kona Hawaii. This blog will be a combination of my real estate work life and my personal adventures in Corvallis, Albany and the surrounding world. Feel free to join me on these new journeys.

Keller Williams Mid Willamette real estate agent

Steve Frisbie is a licensed real estate agent in the State of Oregon. REALTOR®. Equal Opportunity Housing Provider. Each office is independently owned and operated.

Friday, August 24, 2018

Thursday, August 23, 2018

Hanging out at the Starker Arts Park in Corvallis...

Listening to Adam Larson and Company followed by Hillstomp for the final SAGE Summer Concert Series show of the summer.

Here's some Corvallis real estate statistics from July of 2018...

Keller Williams compiles local statistics from the WVMLS and passes it along to their agents each month and we in turn are welcome to share it with the public. It's kind of a handy snapshot to have to see what is going on locally. Click on the pick for a larger view.

To see the July 2018 statistics for Albany click here....

To see the July 2018 statistics for Albany click here....

Floating the Willamette River Between Corvallis and Albany on an inflatable kayak....

This last weekend we decided to break out the inflatable kayaks and float the Willamette River between the boat ramp below the Old Spaghetti Factory in Corvallis down to Hayak Park just this side of Albany.

During the summer, particularly late summer, the Willamette can become fairly busy with drifters and paddlers on kayaks, canoes, innertubes and all manners of watercraft. By late summer the water is relatively comfortable temperature and on a sunny summer day it can be wonderful to be out on the river.

This Sunday was particularly nice, as the smoke from fires froum around the northwest had blown off and the sky was gorgeous. It's about a 9 mile drift/paddle fromthe boat ramp in Corvallis to Hayak Park, and took us about 3.5 hours of time to pretty much float it (with occasional paddling). We left the boat ramp about 10 minutes behind a group of drifters on tubes and maybe beat them by all of 2-4 minutes by the time we'd made it to the park paddling part time. I'd call this stretch of water quite calm. There's an occasional snag along the river's edge you'd want to avoid, but otherwise very little going on as far as fast water or obstacles. The county sheriff's department has a boat and they do check on people throughout the day. Remember your safety accessories... I belive a lifejacket or PFD and a whistle within reach are mandatory. The inflatable kayaks start at 65-85 bucks, other types of rafts or tubes can be less, so it's not an overly expensive event to do, espectially if you plan on doing a bunch of it.

I was surprised by how much there was to look at. I wish I had a better camera ready to go, and be on a boat so I wouldn't be afraid to get it wet. I was using my cell phone in a $5.99 dry box and fumbling around pointing in general directions because I couldn't see in the bright sun. On the float we saw... several osprey (including nesting osprey with chicks), a couple of juvenile bald eagles (they are huge birds, but they are mottled colored until their heads turn white a couple years on), fish jumping, lots of varieties of ducks (including a read headed mohawked one) a great blue heron, a white heron or crane, vultures, swifts and more.

It takes two vehicles to do this, leaving one at each boat ramp, but I can see doing this a lot more in future summers... this was my first time out on the Willamette in years. I've been missing out.

Looks like there's been an increase in the number of price reductions on listings nationally, what can that mean...

What Does the Recent Rash of Price Reductions Mean to the Real Estate Market?

from Keeping Current Matters: For Sellers, Housing Market Updates, Move-Up Buyers, Pricing

Last week, in a new report from Zillow, it was revealed that there has been a rash of price reductions across the country. According to the report:

- There are more price cuts now than a year ago in over two-thirds of the nation’s largest metros

- About 14% of all listings had a price cut in June

- Since the beginning of the year, the share of listings with a price cut increased 1.2%

- This is the greatest January-to-June increase ever reported, and more than double the January-to-June increase last year

Senior Economist Aaron Terrazas further explained:

“A rising share of on-market listings are seeing price cuts, though these price cuts are concentrated at the most expensive price-points and primarily in markets that have seen outsized price gains in recent years.”

What this DOESN’T MEAN for the real estate market…

This doesn’t mean home values have depreciated or are about to depreciate.

A seller may put a home worth $300,000 on the market for $325,000 hoping a bidding war will occur and an overanxious buyer will pay more than its actual value. That has happened often over the last few years. If the seller gets no offers and reduces the price to $300,000, it doesn’t mean the home dropped in value. It is still worth $300,000.

Home prices will continue to appreciate over the next 12 months. In this same report, Terrazas remarks:

“It’s far too soon to call this a buyer’s market, home values are still expected to appreciate at double their historic rate over the next 12 months, but the frenetic pace of the housing market over the past few years is starting to return toward a more normal trend.”

What this DOES MEAN for the real estate market…

This does mean that sellers should be more conservative when it comes to the price at which they list their homes – especially sellers in the upper end of each market.

Sellers have been listing their homes at inflated prices hoping a super-hot market will deliver a buyer willing to pay virtually any price to ensure they don’t lose the house. That strategy has worked somewhat successfully over the last two years. However, the time that strategy would have worked may have passed.

Again, quoting Aaron Terrazas in the report:

“The housing market has tilted sharply in favor of sellers over the past two years, but there are very early preliminary signs that the winds may be starting to shift ever-so-slightly.”

Bottom Line

Prices are not depreciating. However, if you want to sell your house quickly and with the least amount of hassles, pricing it correctly from the beginning makes the most sense.

Tuesday, August 21, 2018

Home ownership can be a great way to build wealth...

The Net Worth of a Homeowner is 44x Greater Than A Renter!

from Keeping Current Matters: First Time Home Buyers, For Buyers, Move-Up Buyers, Rent vs. Buy

- Every three years, the Federal Reserve conducts their Survey of Consumer Finances in which they collect data across all economic and social groups. Their latest survey data, covering 2013-2016 was recently released.

The study revealed that the median net worth of a homeowner was $231,400 – a 15% increase since 2013. At the same time, the median net worth of renters decreased by 5% ($5,200 today compared to $5,500 in 2013).

These numbers reveal that the net worth of a homeowner is over 44 times greater than that of a renter.

Owning a home is a great way to build family wealth

As we’ve said before, simply put, homeownership is a form of ‘forced savings.’ Every time you pay your mortgage, you are contributing to your net worth by increasing the equity in your home.

That is why, for the fifth year in a row, Gallup reported that Americans picked real estate as the best long-term investment. This year’s results showed that 34% of Americans chose real estate, followed by stocks at 26% and then gold, savings accounts/CDs, or bonds.

Greater equity in your home gives you options

If you want to find out how you can use the increased equity in your home to move to a home that better fits your current lifestyle, let’s get together to discuss the process.

Sunday, August 19, 2018

Here's some Albany Oregon real estate statistics from July 2018...

It looks as though inventory is still down from last year, but things are selling well. One note: When looking at the Days on Market category, keep in mind those numbers include all of the time a home was under contract and many or most had 30-45 days to close once they went under contract. It would also include properties that went under contract, the deal fell through, then went back under contract, and other's that have yet to sell, so when you are looking at 60-100 days on the market, a great many of those (especially when you are looking at that 150k to 300k price range) may have had accepted offers in just a few days. Homes are selling well.

To see the Corvallis Oregon July 2018 statistics click here....

Saturday, August 18, 2018

Does everyone need 20% down to buy a house.... NO!

First-Time Home Buyers Continue to Put Down Less Than 6%!

According to the Realtors Confidence Index from the National Association of Realtors, 61% of first-time homebuyers purchased their homes with down payments below 6% in 2017.

Many potential homebuyers believe that a 20% down payment is necessary to buy a home and have disqualified themselves without even trying, but in March, 71% of first-time buyers and 54% of all buyers put less than 20% down.

Many potential homebuyers believe that a 20% down payment is necessary to buy a home and have disqualified themselves without even trying, but in March, 71% of first-time buyers and 54% of all buyers put less than 20% down.

Ralph McLaughlin, Chief Economist and Founder of Veritas Urbis Economics, recently shed light on why buyer demand has remained strong,

“The fact that we now have four consecutive quarters where owner households increased while renters households fell is a strong sign households are making the switch from renting to buying.Households under 35 – which represent the largest potential pool of new homeowners in the U.S. – have shown some of the largest gains. While they only make up a third of all homebuyers, the steady uptick in their homeownership rate over the past year suggests their enormous purchasing power may be finally coming to [the] housing market.”

It’s no surprise that with rents rising, more and more first-time buyers are taking advantage of low-down-payment mortgage options to secure their monthly housing costs and finally attain their dream homes.

Bottom Line

If you are one of the many first-time buyers unsure of whether or not they would qualify for a low-down payment mortgage, let’s get together and set you on your path to homeownership!

Here's a national real estate statistics chart by the NAR....Looks like we've had 3 years of shrinking inventory levels....

And we just had a year over year increase in the last month for the first time in a while if I'm reading this Nationa Association of Realtors graphic correctly.

Friday, August 17, 2018

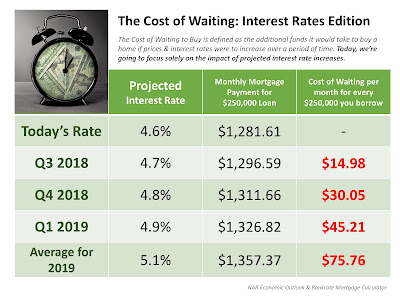

How much will higher interest rates on home loans cost me if I wait to buy?...

The Cost of Waiting: Interest Rates Edition [INFOGRAPHIC]

From Keeping Current Matters: First Time Home Buyers, For Buyers, Infographics, Interest Rates, Move-Up Buyers

Some Highlights:

- Interest rates are projected to increase steadily heading into 2019.

- The higher your interest rate, the more money you end up paying for your home and the higher your monthly payment will be.

- Rates are still low right now – don’t wait until they hit 5% to start searching for your dream home!

Thursday, August 16, 2018

How's the housing market? Compared to a decade ago the inventory of homes available for sale is quite low....

Housing Market: Another Gigantic Difference Between 2008 and 2018

From Keeping Current Matters: First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

Some are attempting to compare the current housing market to the market leading up to the “boom and bust” that we experienced a decade ago. They look at price appreciation and conclude that we are on a similar trajectory, speeding toward another housing crisis.

However, there is a major difference between the two markets. Last decade, while demand was being artificially created by extremely loose lending standards, a tremendous amount of inventory was coming to the market to satisfy that demand. Below is a graph of the inventory of homes available for sale leading up to the 2008 crash.

A normal market should have approximately 6 months supply of housing inventory. As we can see, that number jumped to over 11 months supply leading up to the housing crisis. When questionable mortgage practices ceased, and demand dried up, there was a glut of inventory on the market which caused prices to drop as there was too much supply and not enough demand.

Today is radically different!

There are those who believe that low mortgage rates have created an artificial demand in the current market. They fear that if mortgage rates continue to rise, some of the current demand will dry up (which is a possibility).

There are those who believe that low mortgage rates have created an artificial demand in the current market. They fear that if mortgage rates continue to rise, some of the current demand will dry up (which is a possibility).

However, if we look at supply again, we can see that the current supply of homes is well below the norm of 6 months.

Bottom Line

We will not have a glut of inventory like we did back in 2008 and home values won’t come tumbling down. Instead, if demand weakens, we will return to a normal market (approximately a 6-month supply) with historic levels of appreciation (3.6% annually).

Subscribe to:

Posts (Atom)